Countering falling markets & rising inflation

Graeme looks at a possible option to counter the falling markets and rising inflation - in this public post.

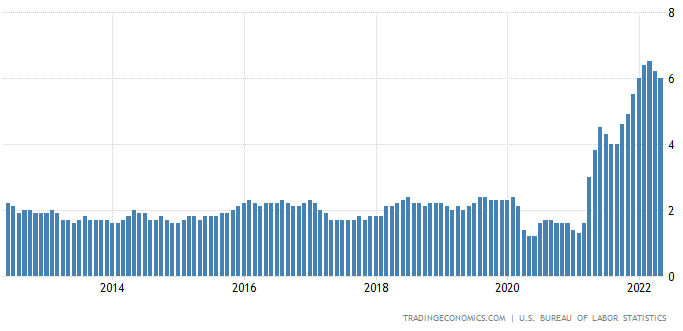

Markets are falling, and falling hard, while US inflation has been rising steeply since the start of 2021.

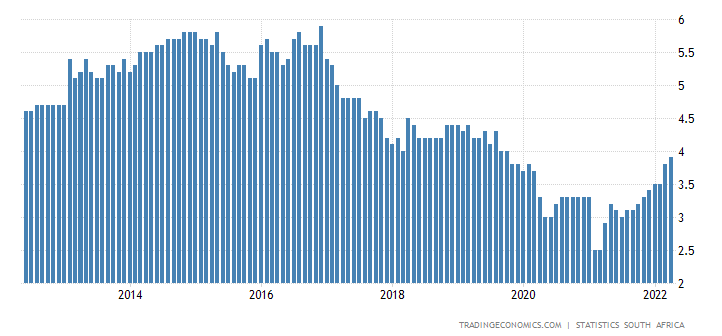

This was always going to spill over to SA, and we can see this in the next chart, where 2021 saw inflation rising as expected.

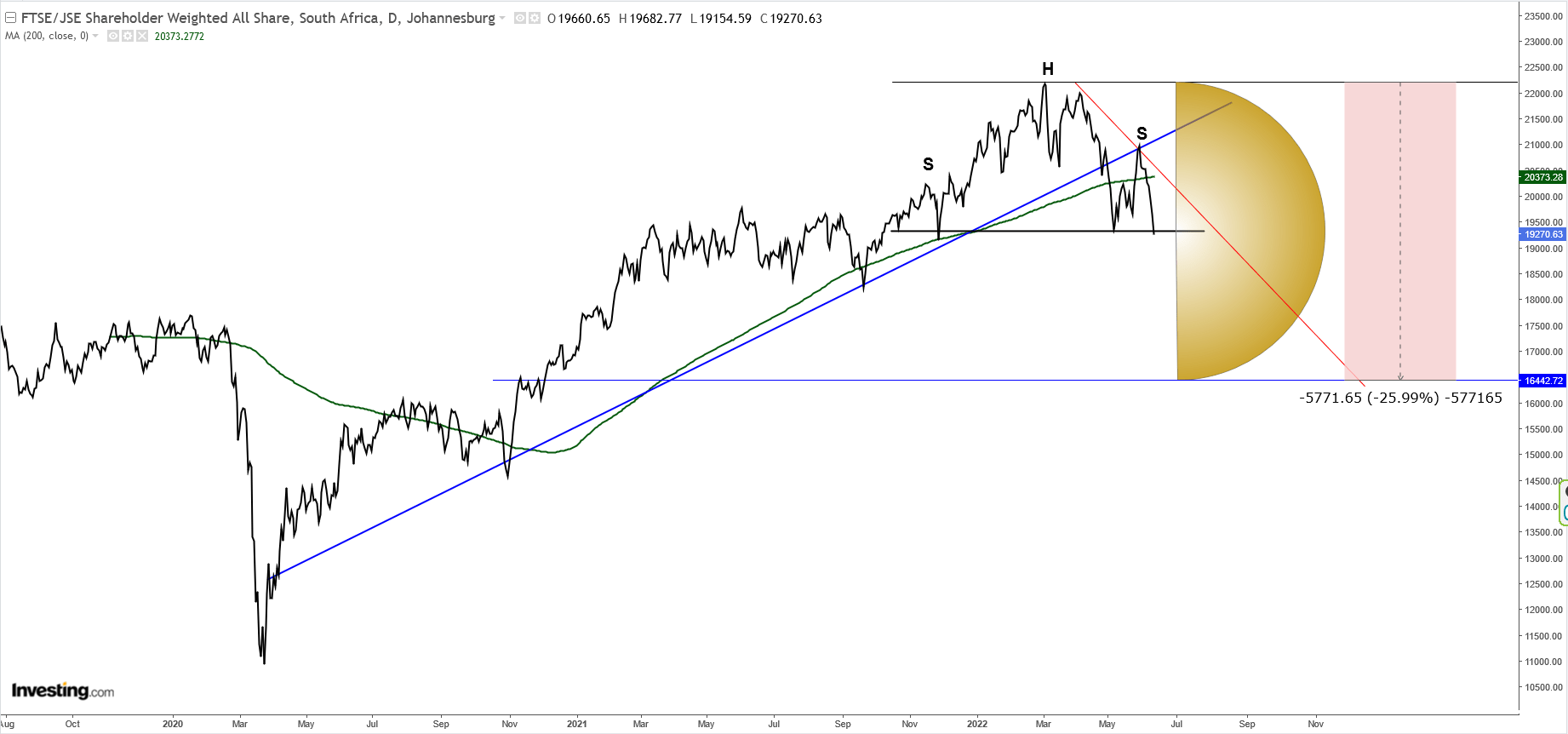

With this as a backdrop, we also watched as the JSE Allshare broke it's uptrend and moved into a stage 3 top, which is now almost certain to transition into a stage 4 decline, following the US markets. We also have a large Head-and-Shoulder pattern which projects the index down to a level where it would drop to at least 26% below the all-time high set back at the beginning of March. See also my earlier post where I looked at the prospects for the S&P500.

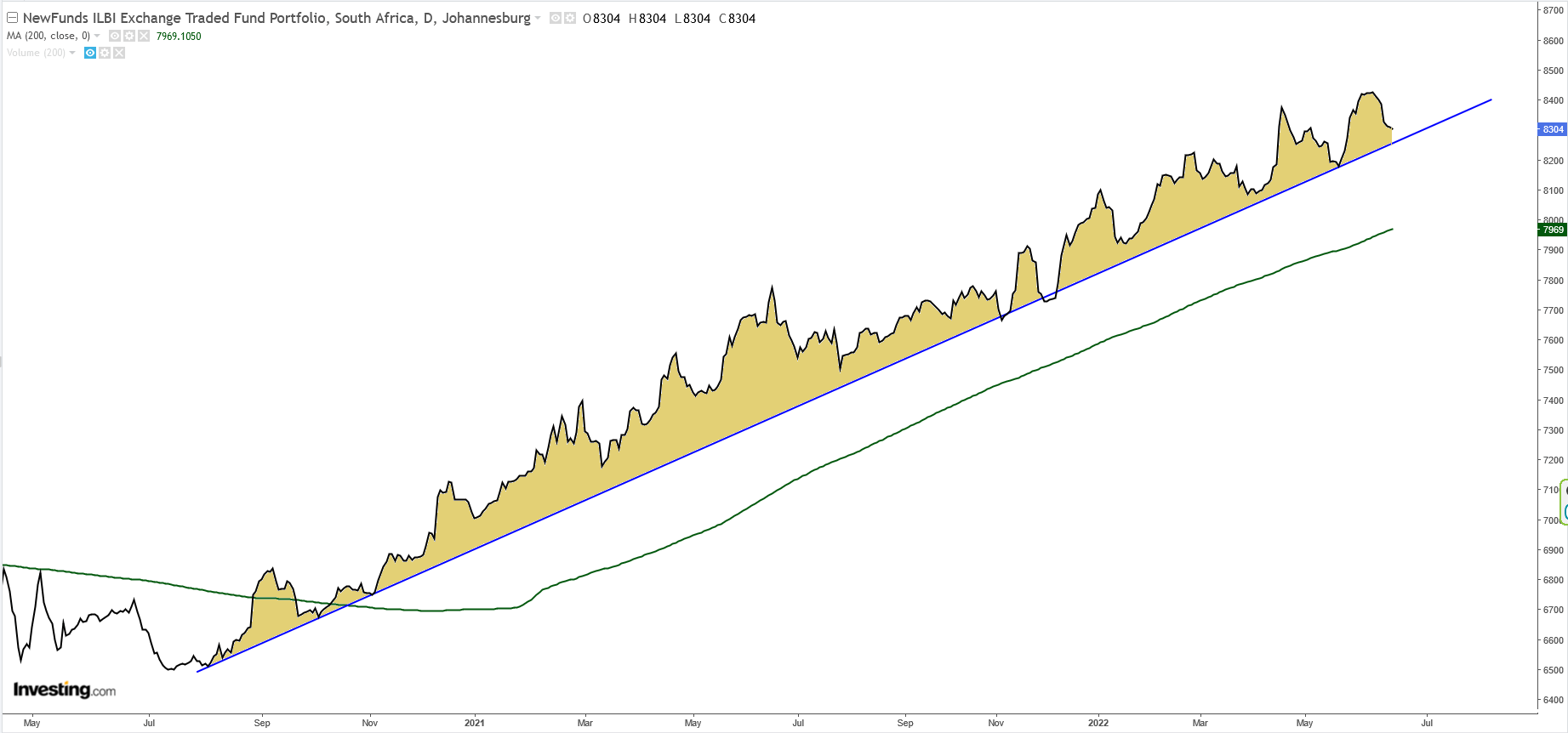

There are various ways to counter this double whammy. Moving to cash is an obvious one, but that won't counter inflation. There are other ways too, and here's one option that I like under these conditions. Inflation-linked bonds rise with inflation and are trending steadily upward (currently trending @ roughly 12.5% pa excluding dividends).

That looks very attractive compared to a potential 26% fall in equities. These are certainly worth considering, especially under these circumstances, but should inflation start to reverse, then one would obviously look to exit.

Comments ()