Breakouts: Things are Looking Bad Generally...

Things looking bad generally a look at indexes, commodities, forex and stocks for the last fortnight

The End October 2023 update - most indexes are giving the indications a down trend (starting or continuing). Supports have been wiped out and now the stage of the next leg down looks upon us. A handful of stocks, commodities and currencies looking good.

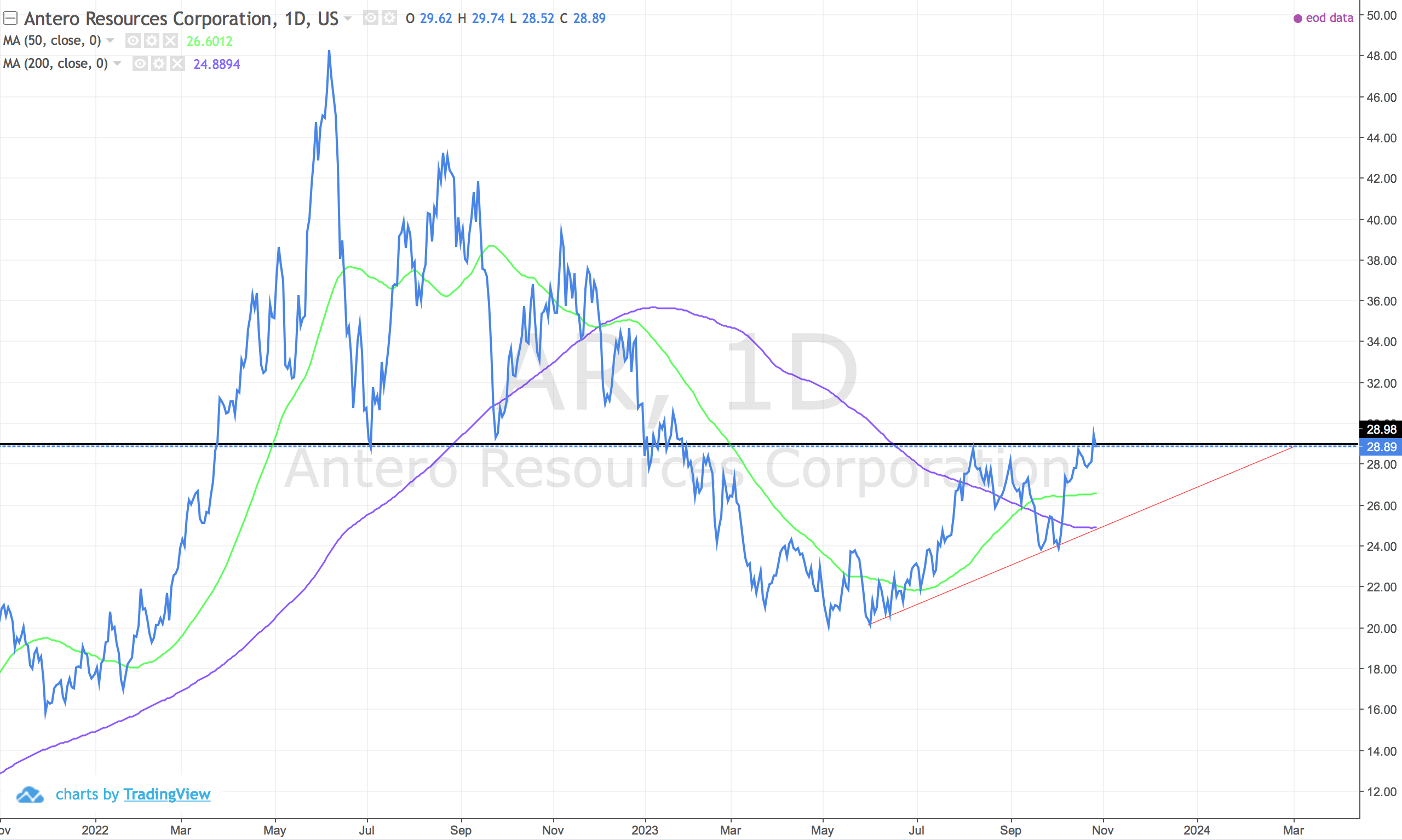

- On the up: USDZAR, BTCUSD, Crude Oil, Natural gas, US:MSRT (Microstrategy) and US:AR (Antero Resources)

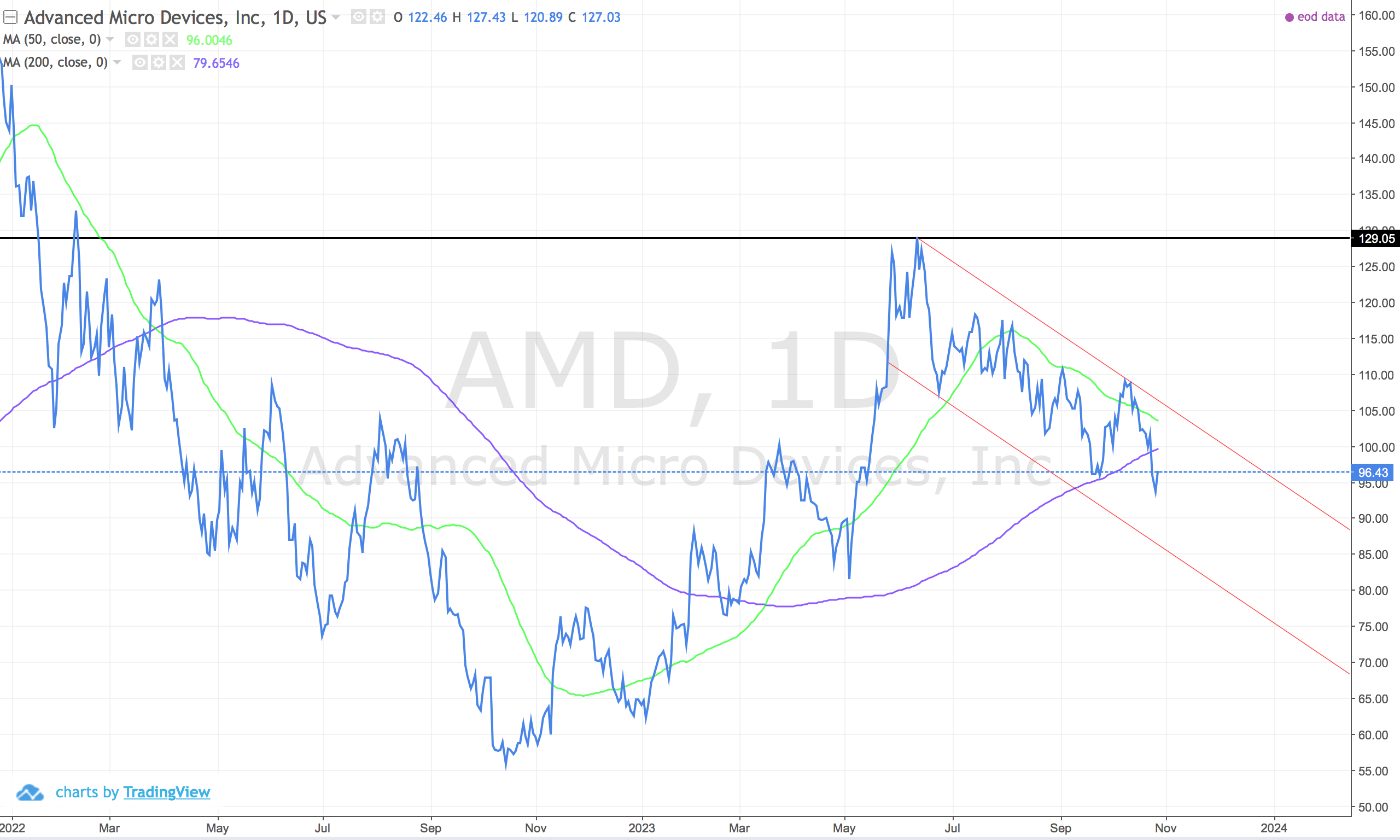

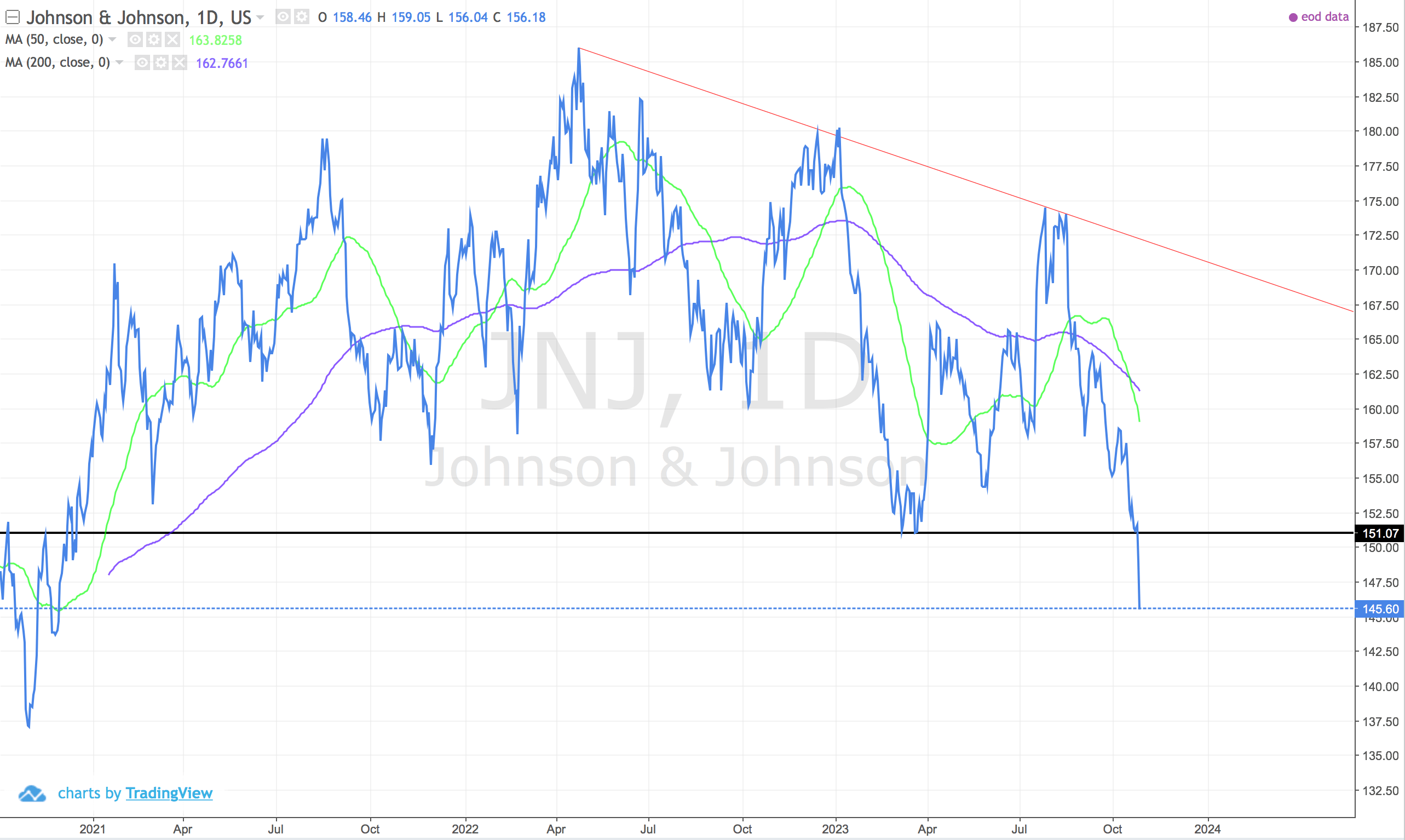

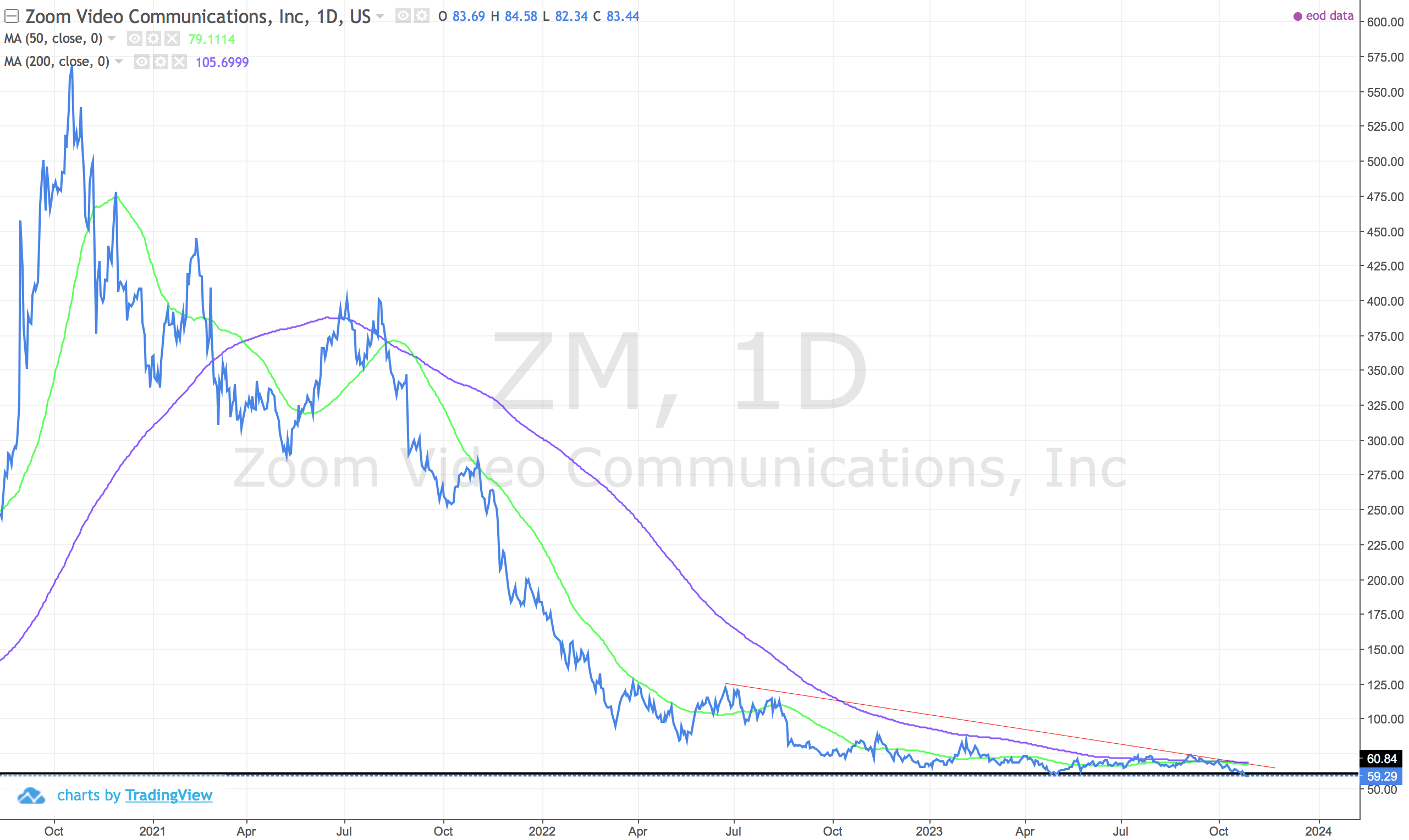

- On the down: S&P500, JSE:STX40 (Satrix40), JSE:BTI (Bats), JSE:CLS (Clicks), JSE:STXPRO (Satrix Property ETF), JSE:RNI (Reinet), JSE:SYG4IR (Sygnia 4th Ind Rev), JSE:STXCHN (Satrix China ETF), JSE:SYGP (Sygnia Property), JSE:ABG (Absa), JSE:BAW (Barloworld), JSE:BLK (Blackrock), US:USRT (US Reit), US:AMD, US:JNJ (Johnson and Johnson), US:ZM (Zoom), US:F (Ford)

- Hard to call: Gold, US:NFLX (Netflix)

Ideas only. Nothing is certain. Make decisions that are right for your trading and investing strategy.

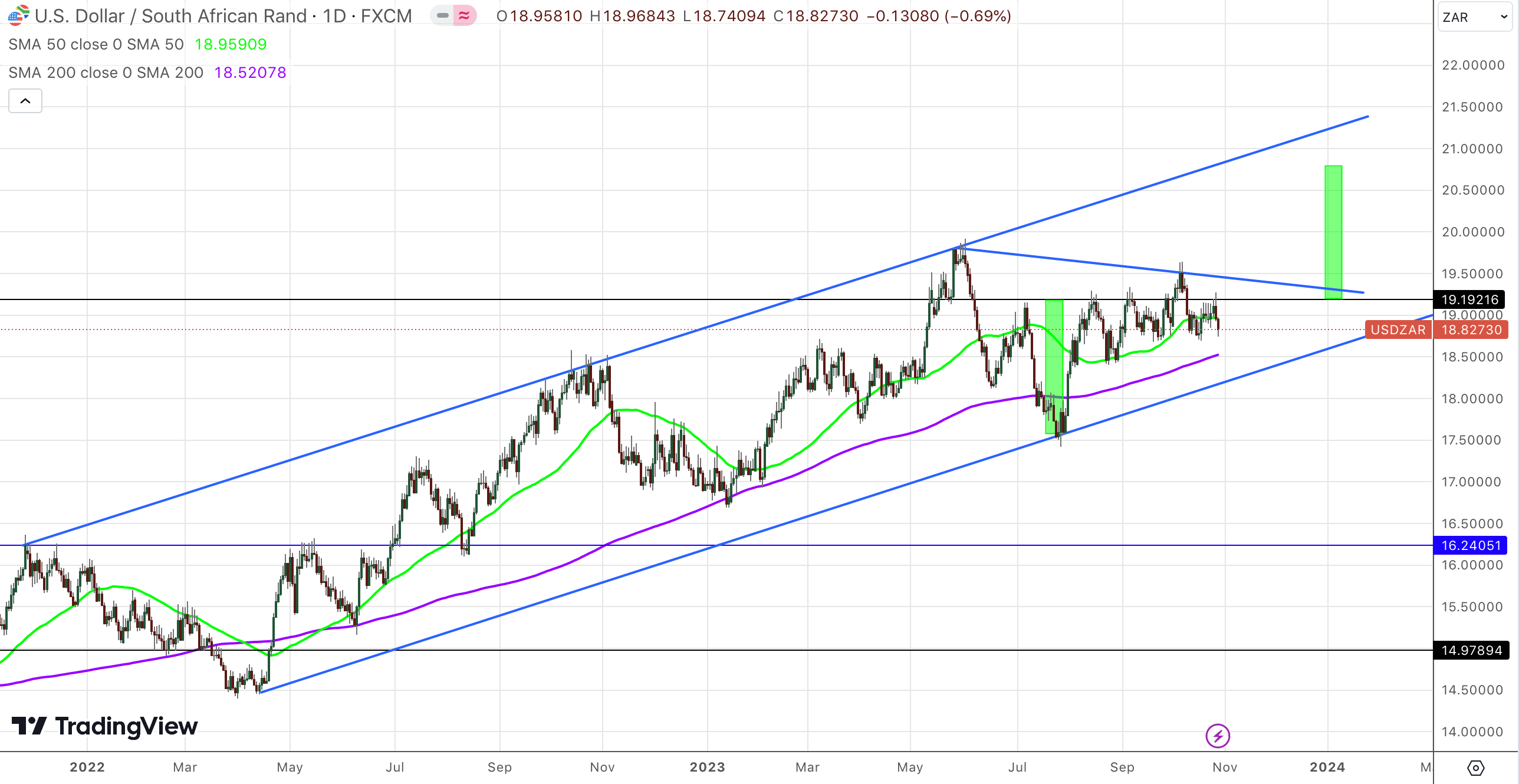

USDZAR (Dollar-Rand)

Still in the upward channel. Staying under resistance for now. Set to eventually pop above the resistance and continue to $21 in 2024.

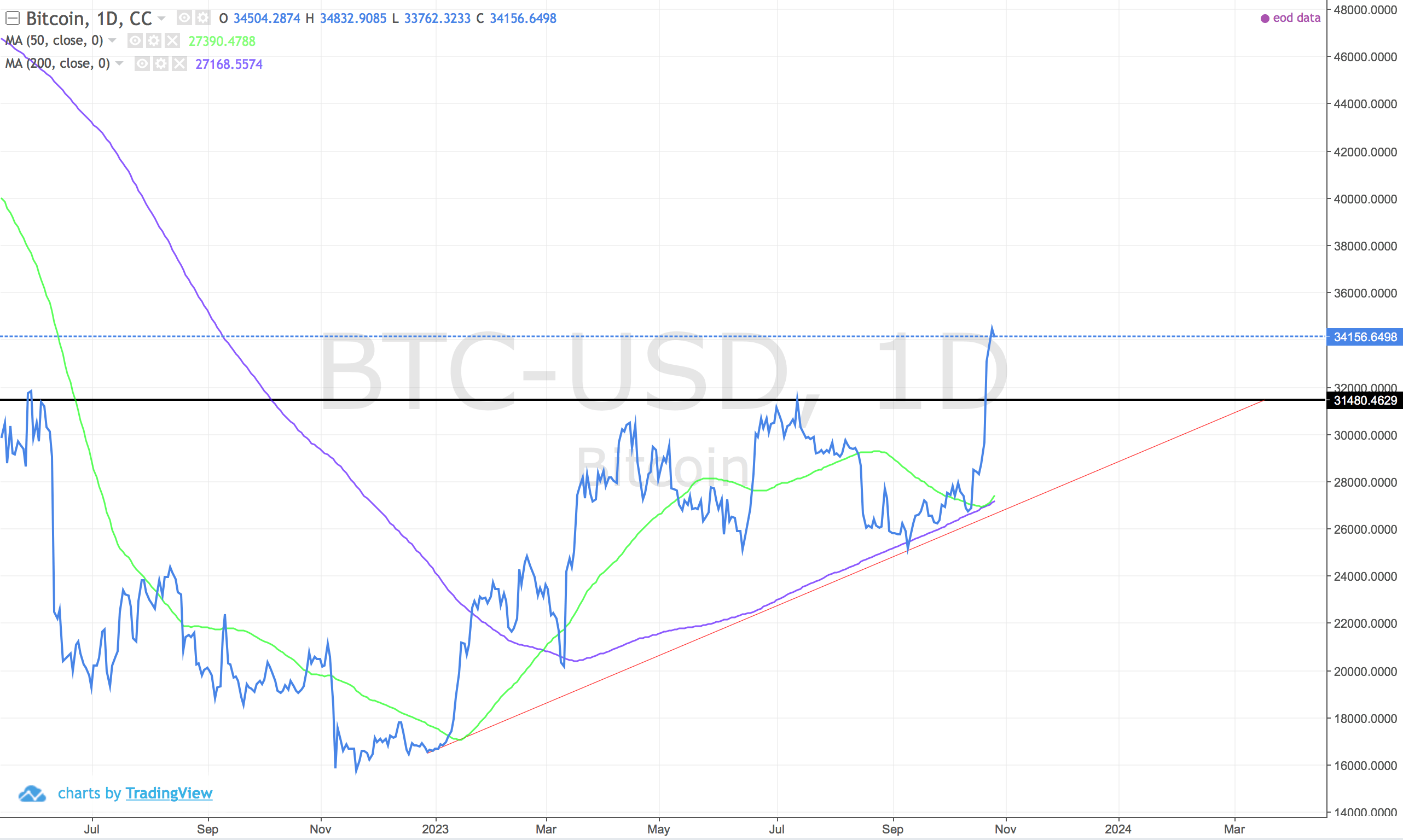

BTCUSD (Bitcoin-Dollar)

Trending up. Cup and handle projects up to 45k mid term.

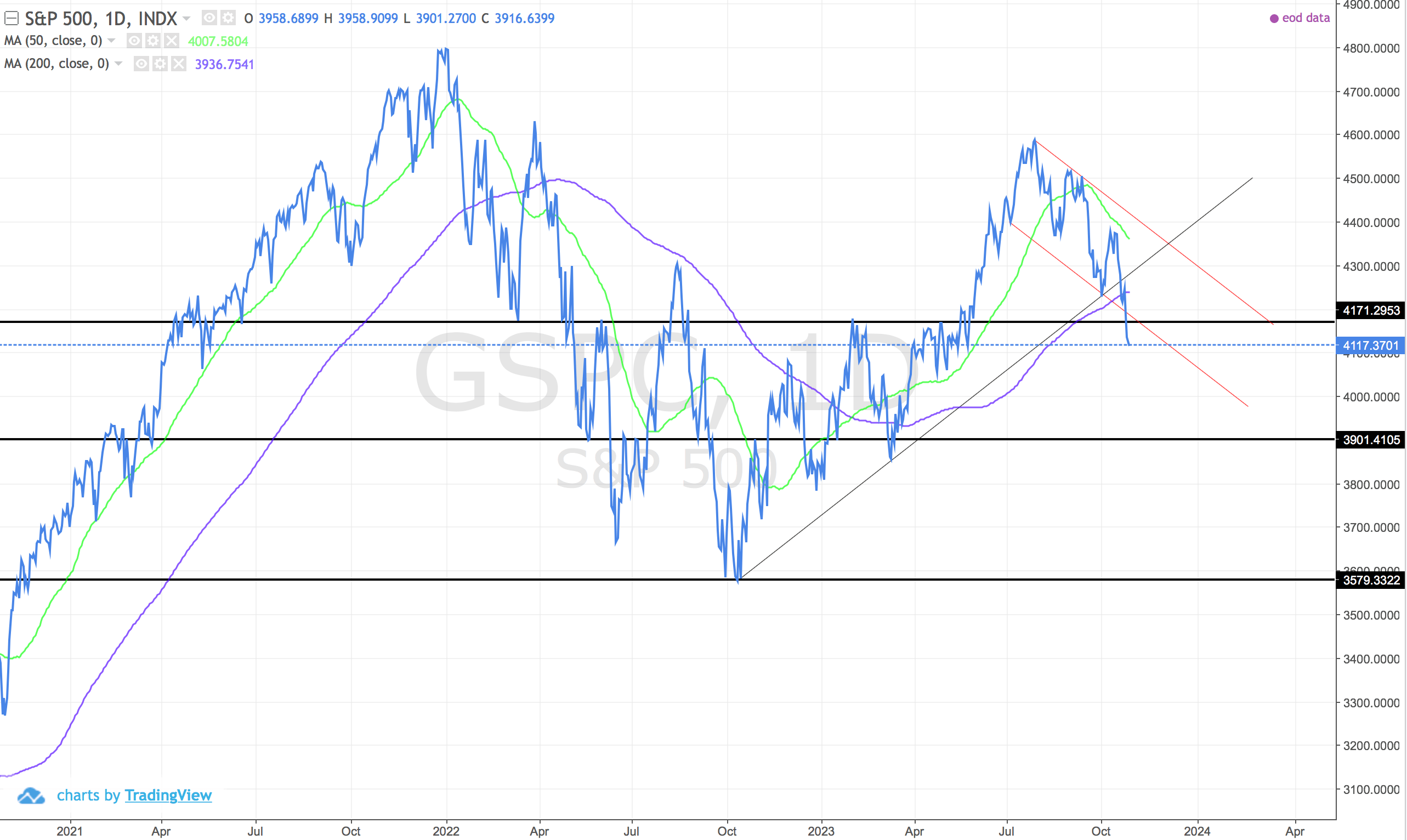

GSPC (S&P 500)

Negative break below the downward channel. Breaks through support. Unfortunately 3900 is the next stop. Keep an eye out - may be dangerous times ahead.

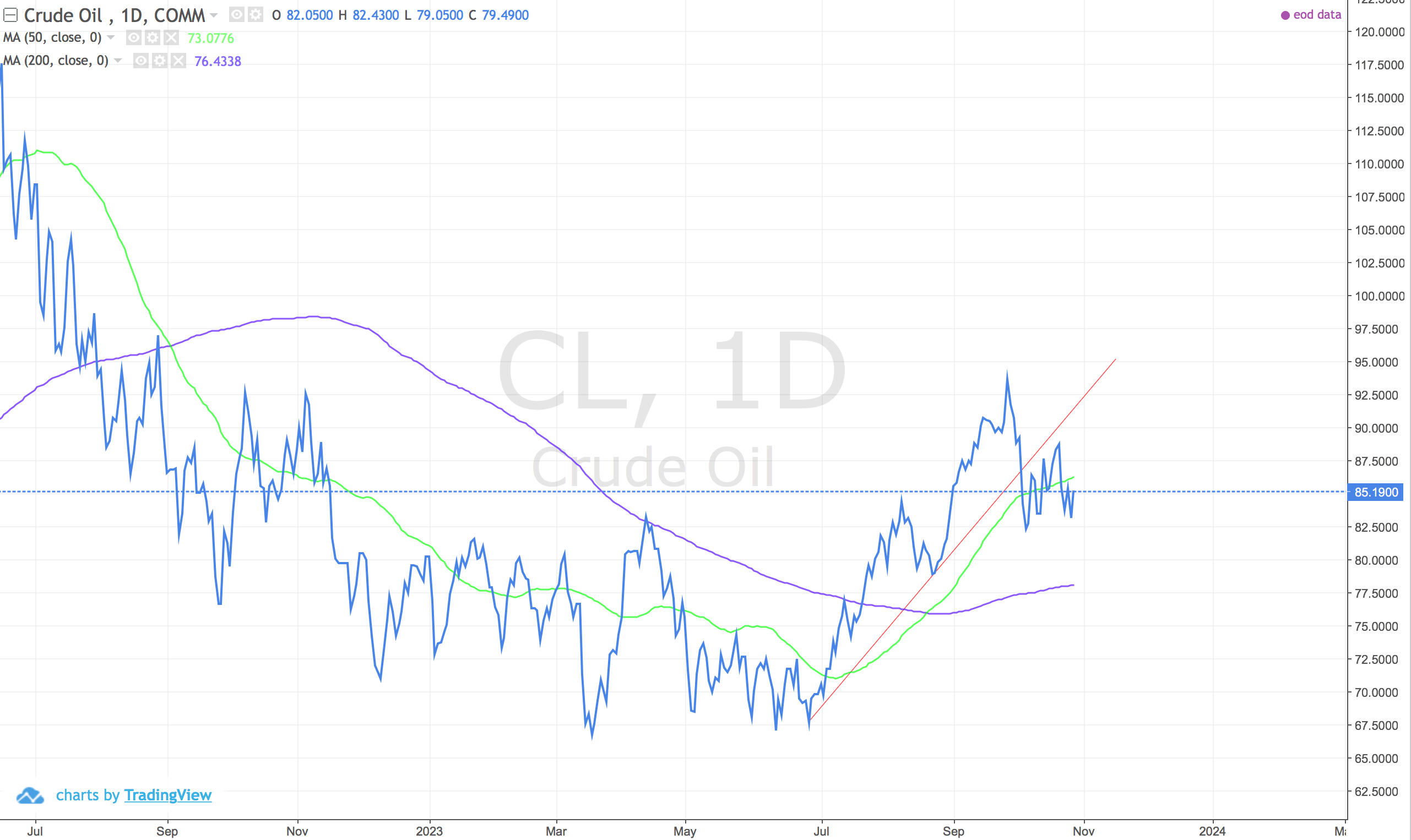

CL (Crude Oil)

Trending up. Price still under the trendline support though.

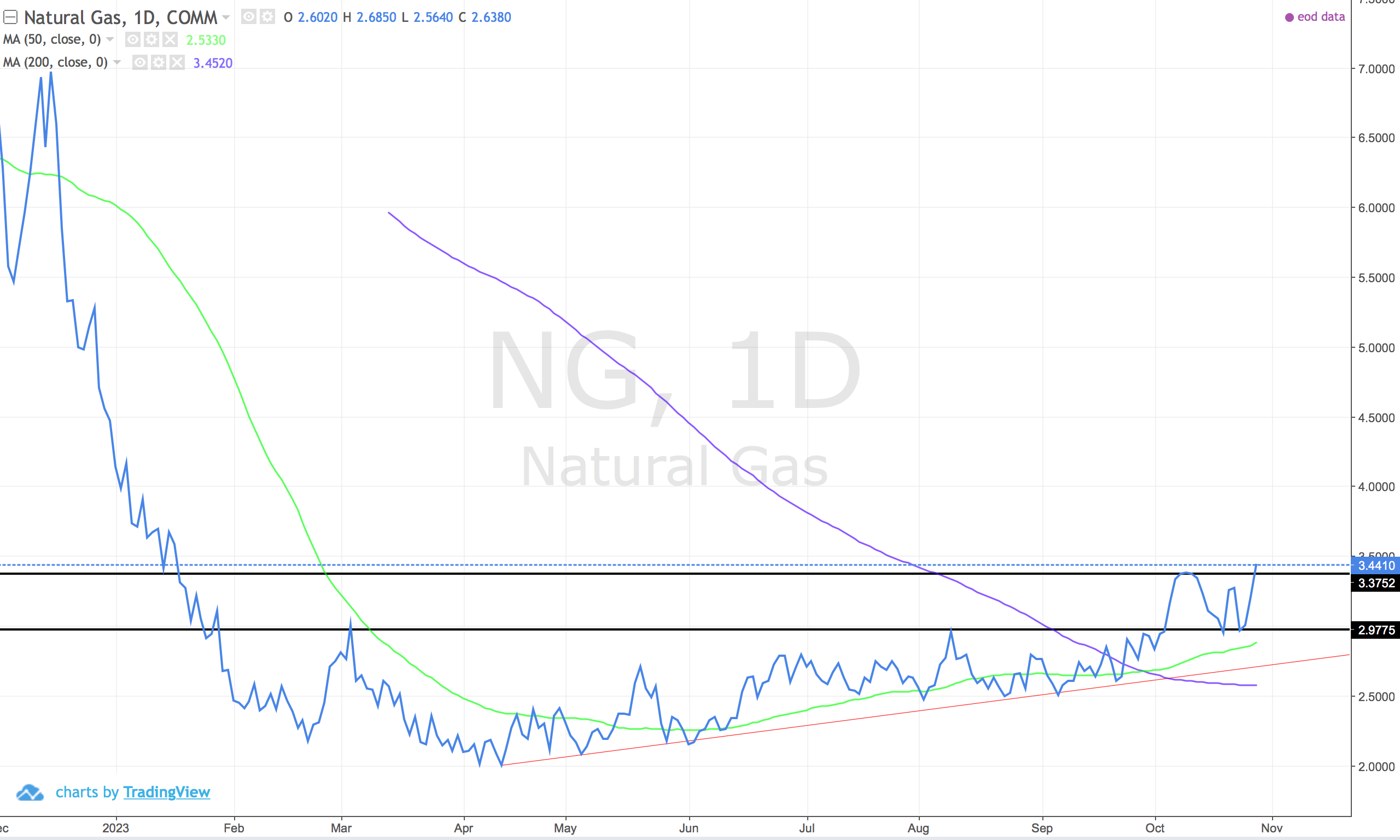

NG (Natural Gas)

Higher high. Looking good target of $4 still in play.

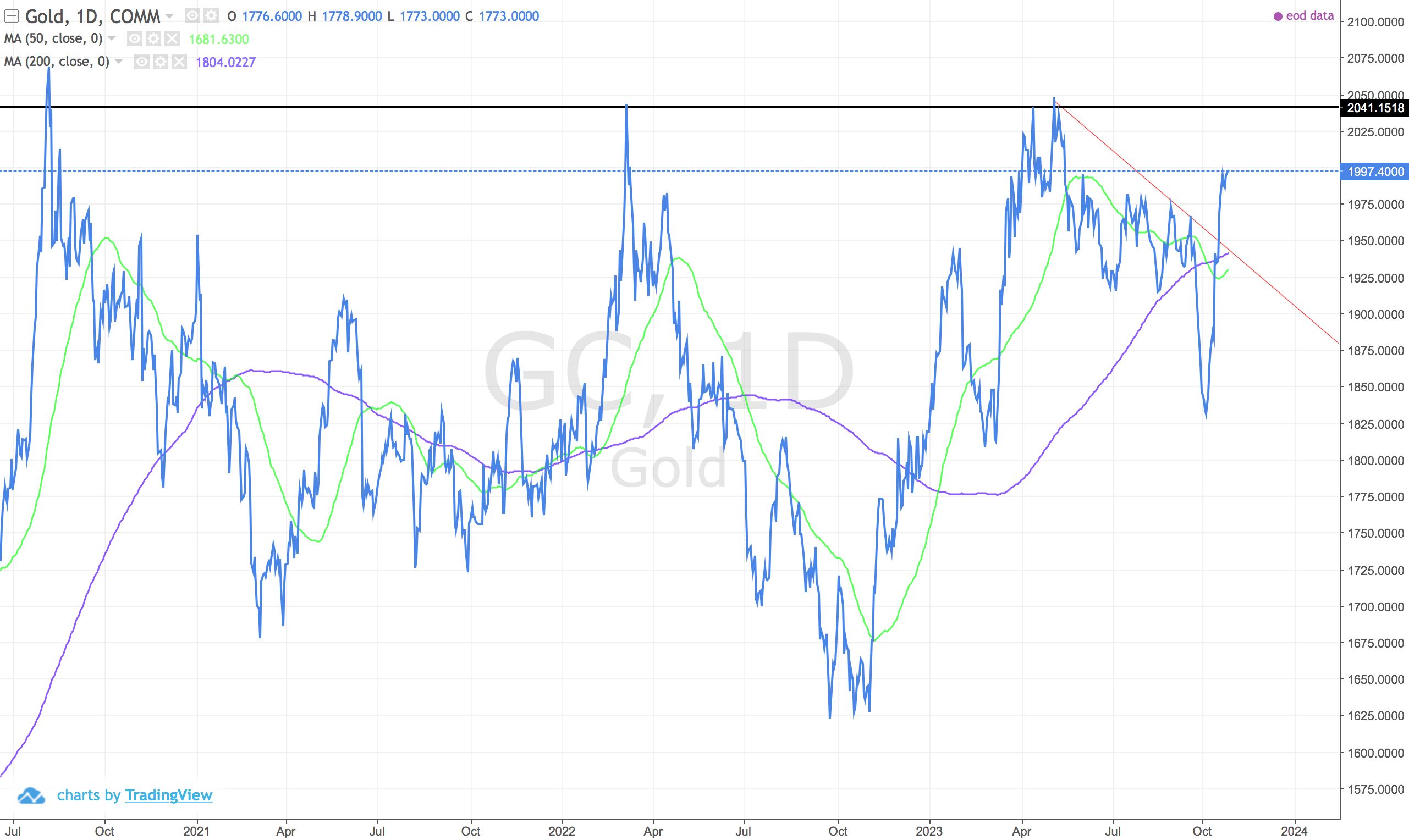

GC / XAUUSD (Gold)

Positive break above the resistance. Still the big resistance overhead at $2041. Even if it breaks through that price could reverse...it is gold after all.

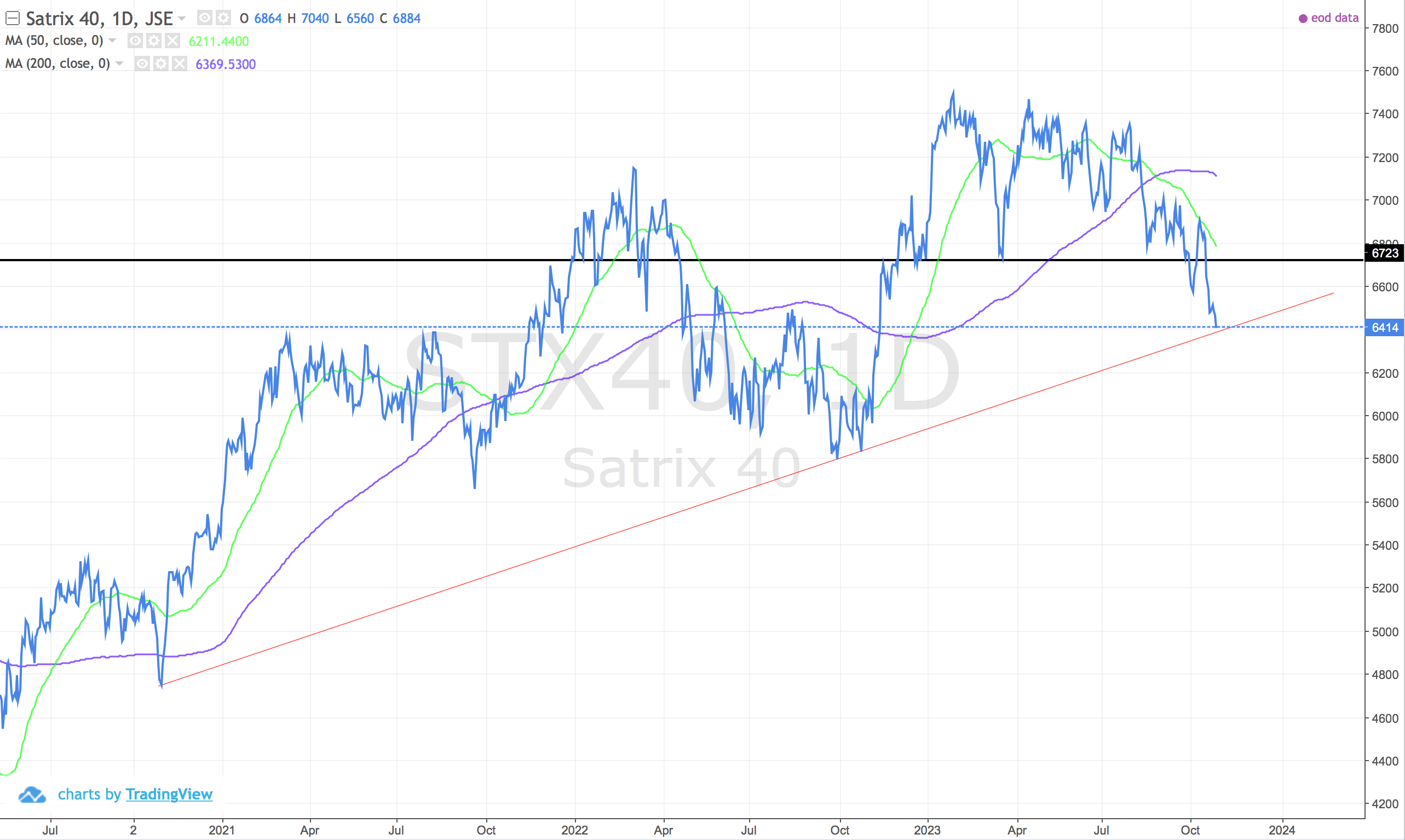

JSE:STX40 (Satrix 40)

Barely hanging on to the trend line. Failing that 5800 opens up.

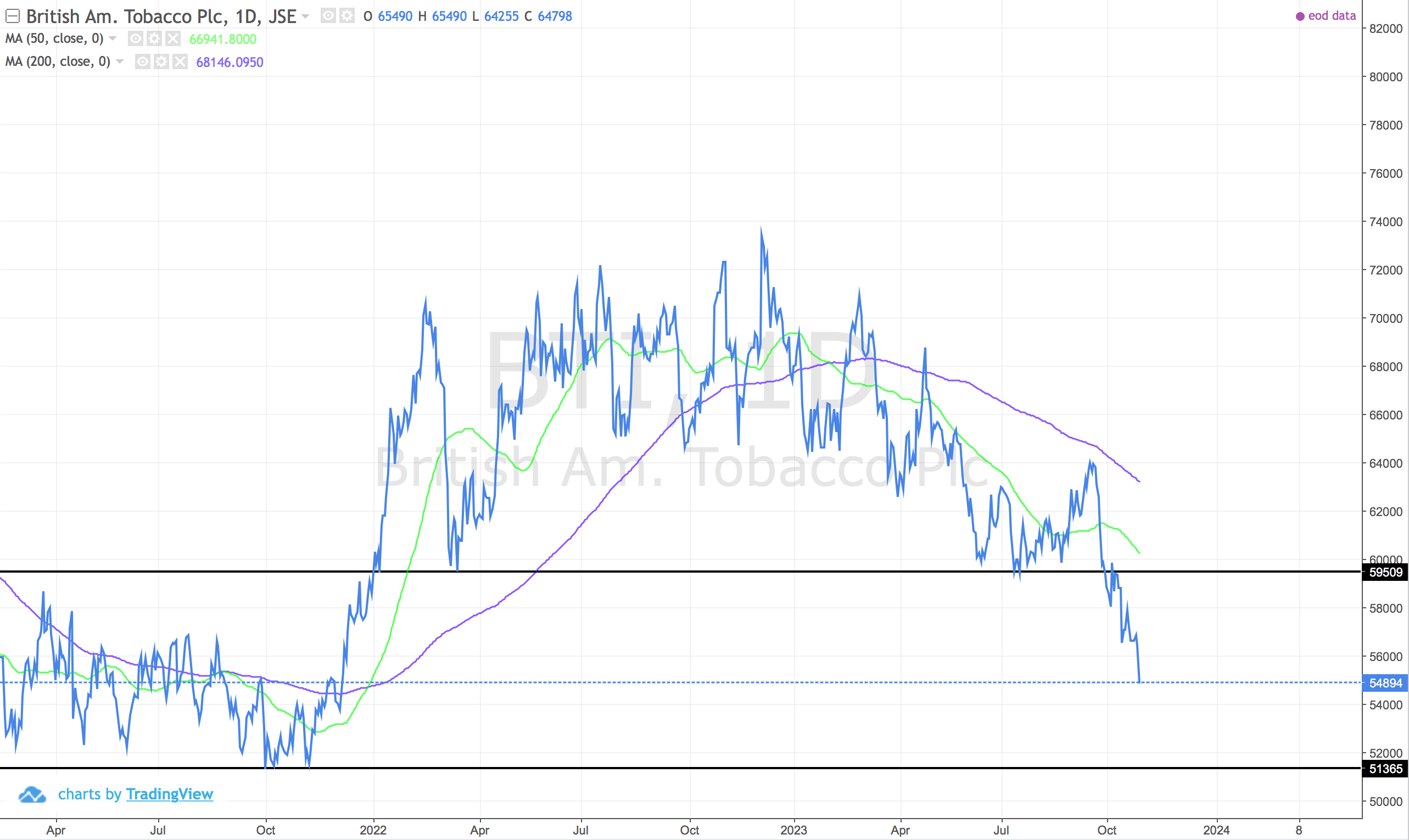

JSE:BTI (Bats)

Negative break. Trending down to support at 51365.

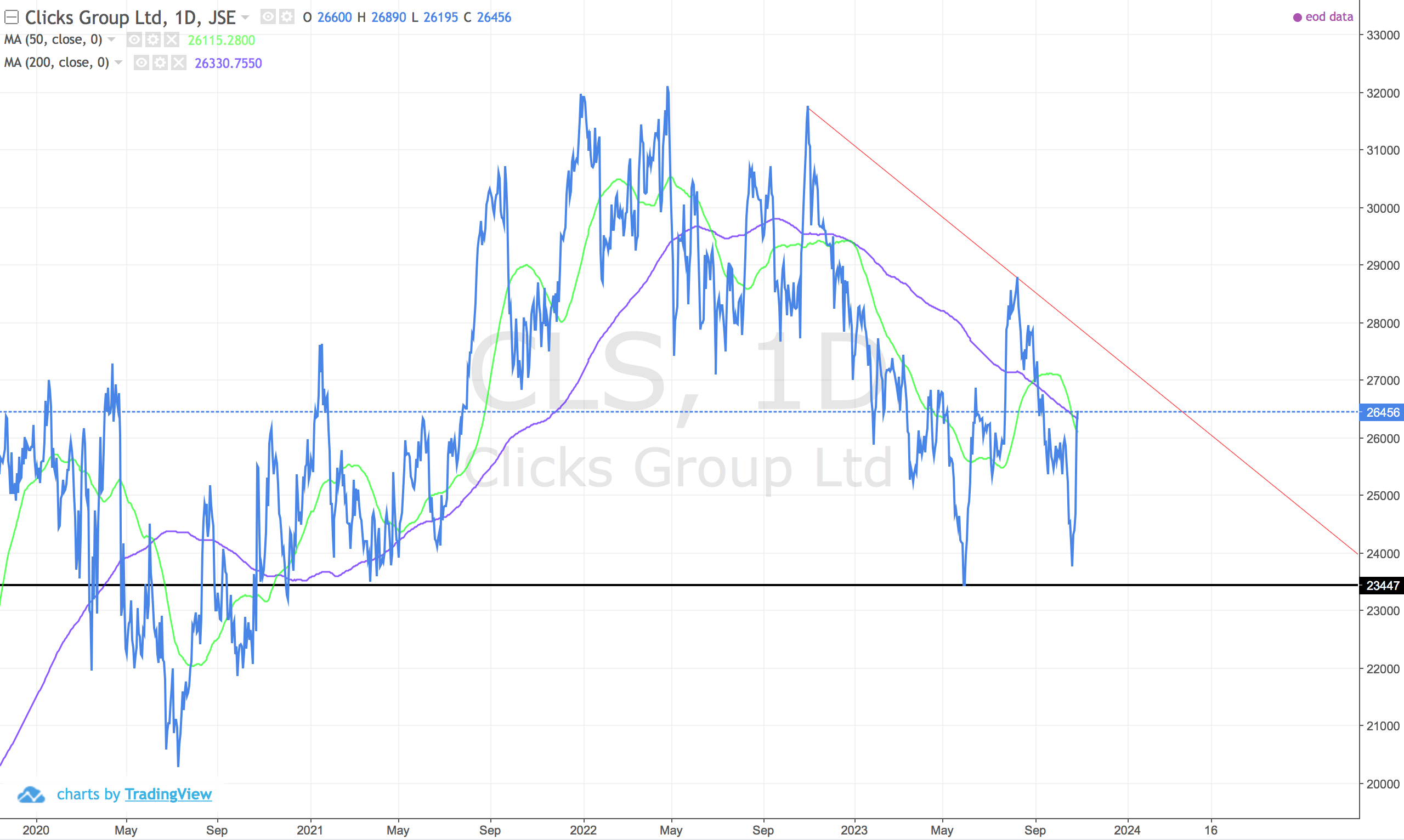

JSE:CLS (Clicks)

Negative break. Trending down.

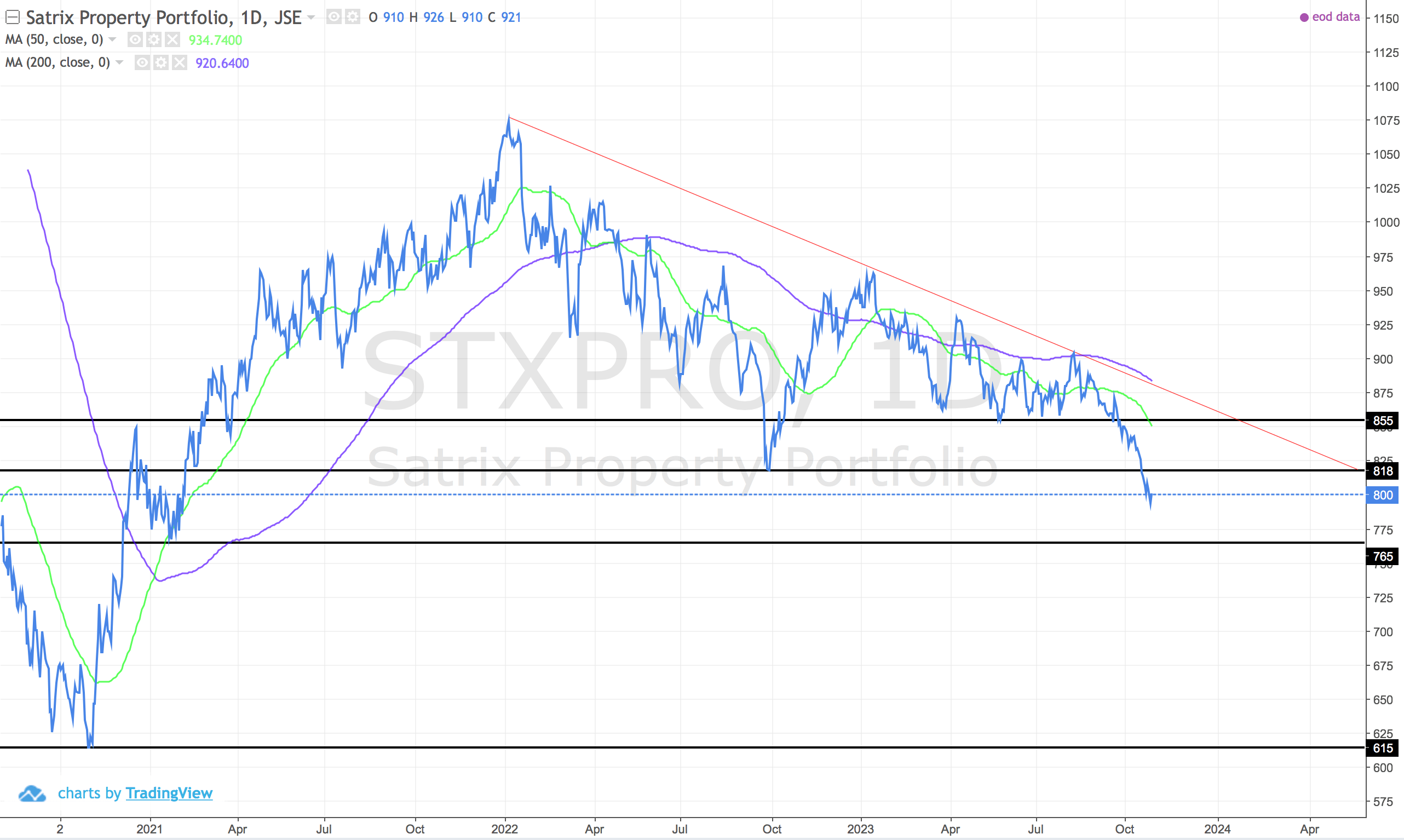

JSE:STXPRO (Satrix Property ETF)

Negative break. Lower low. Trending down. Massive descending triangle. Careful if you are banking on this and SA property in general. Next stop 765.

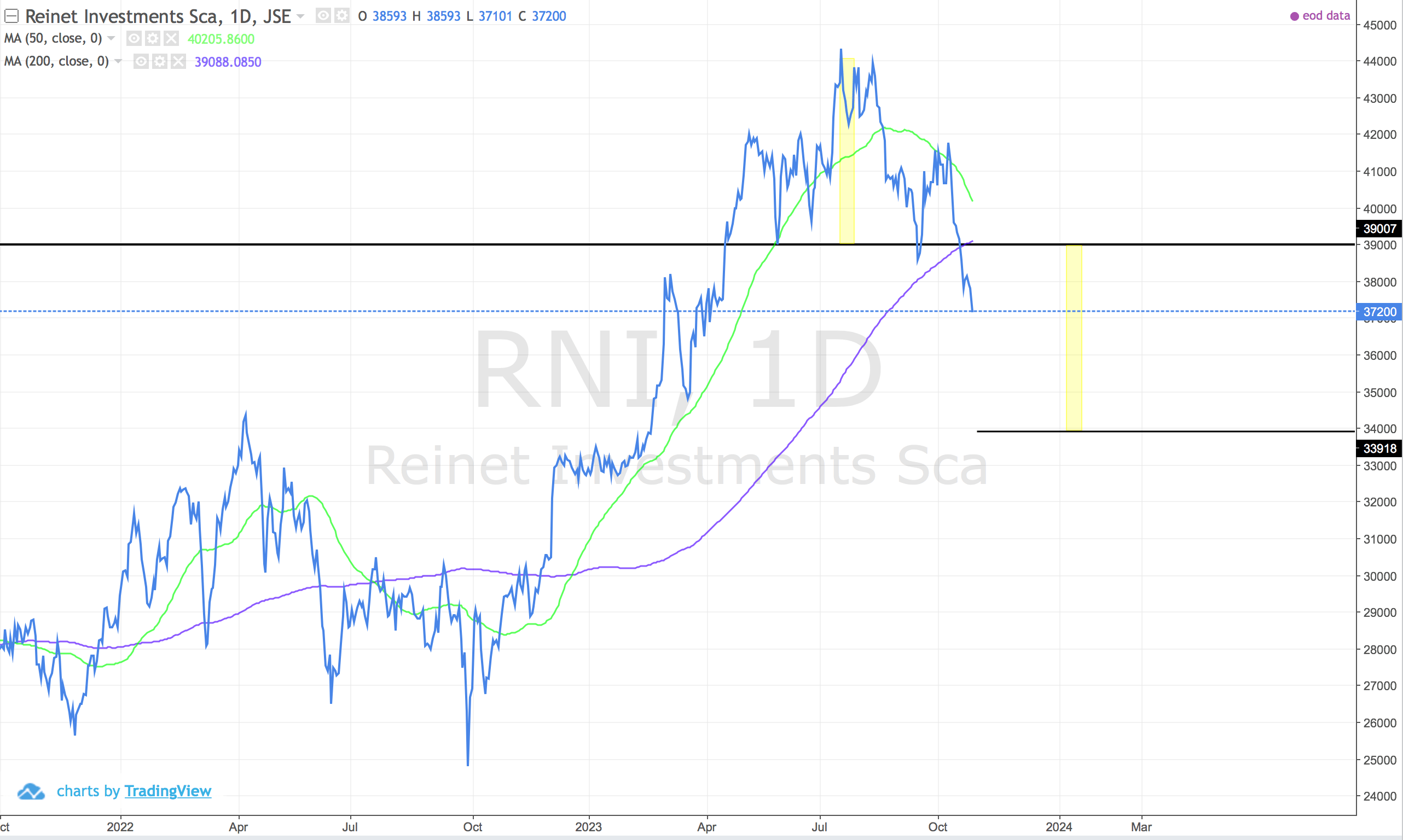

JSE:RNI (Reinet)

Negative break. Head and shoulders pattern projects down to 34000.

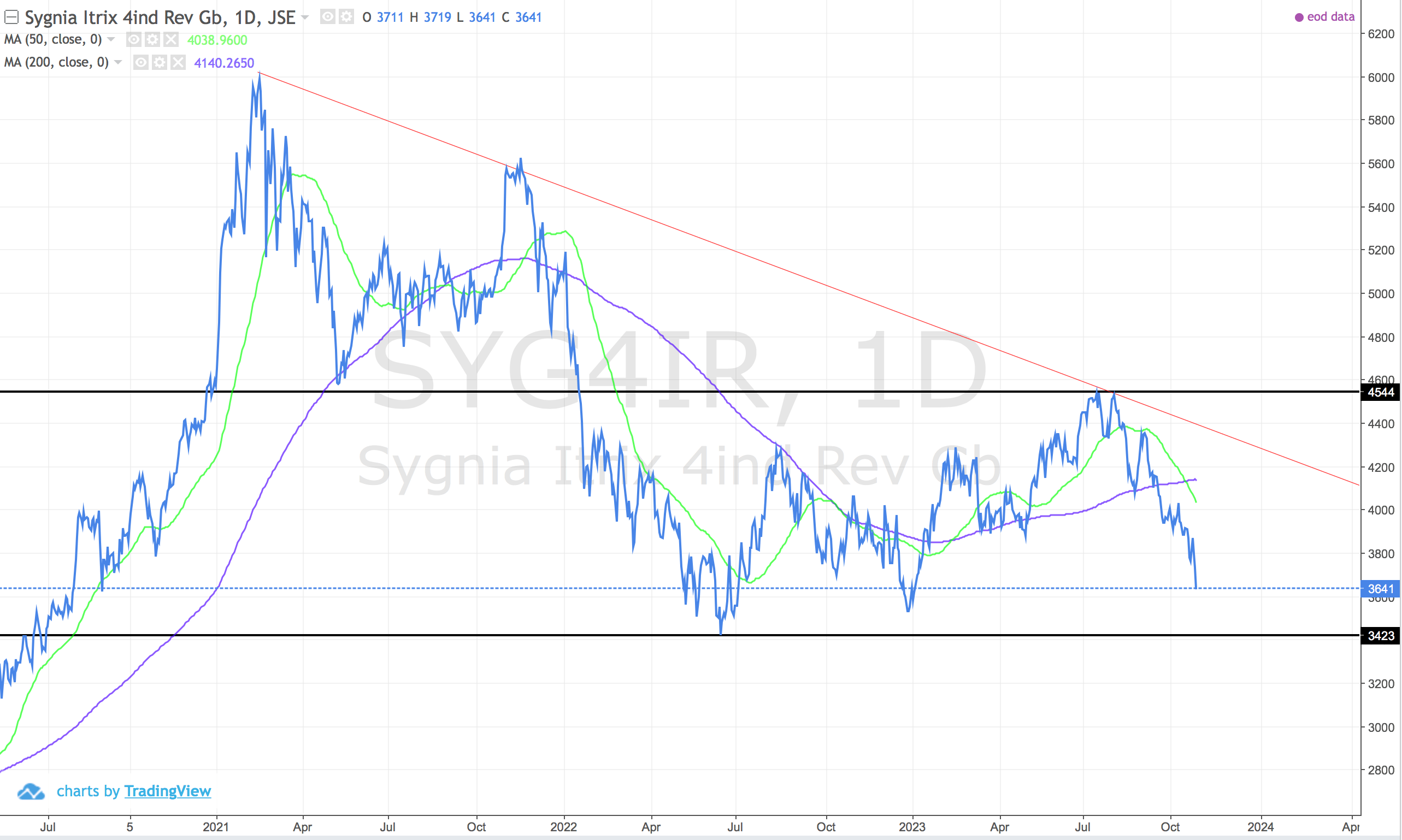

JSE:SYG4IR (Sygnia 4th Ind ETF)

Negative break. Descending triangle. Trending down.

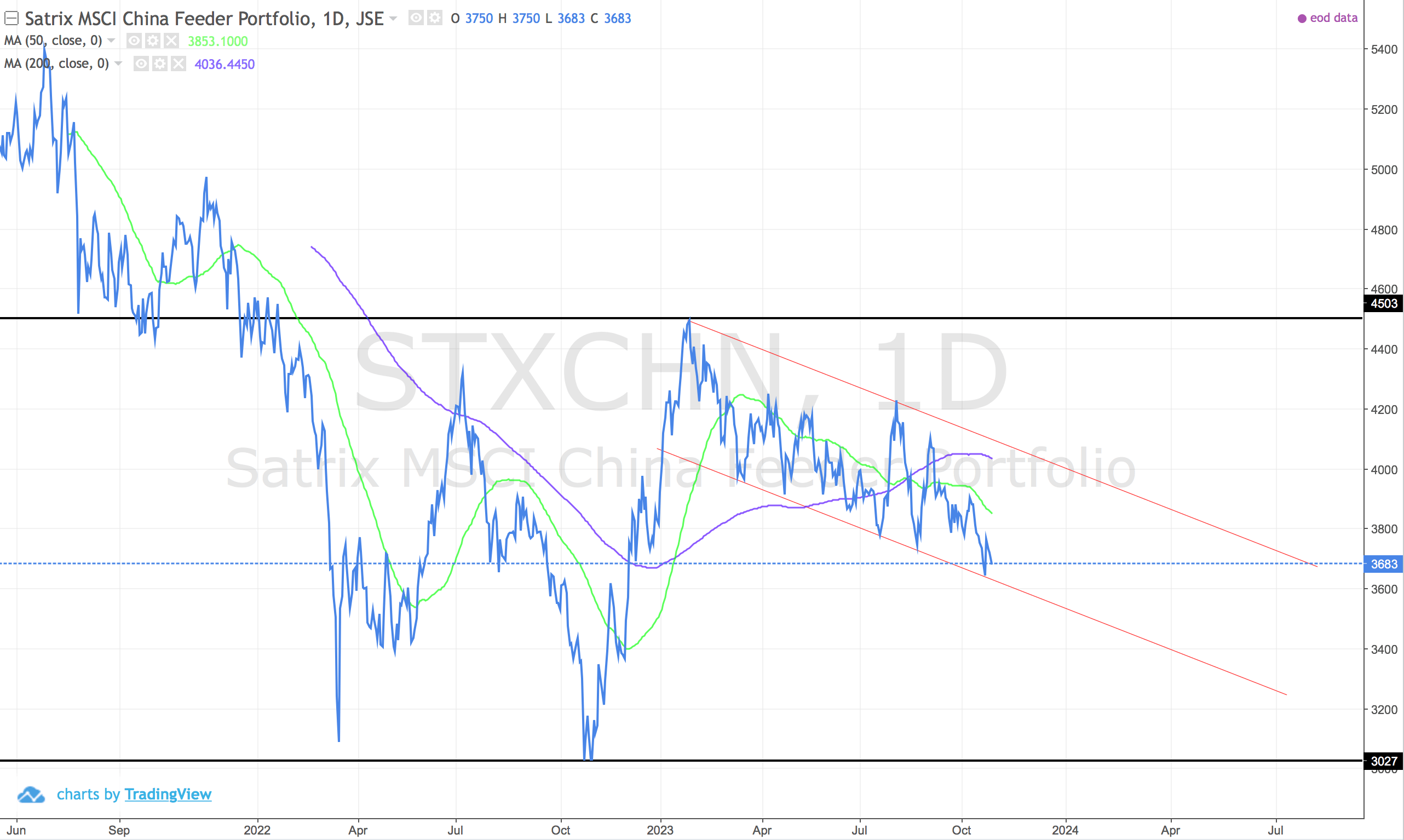

JSE:STXCHN (Satrix China ETF)

Downward trend. Nice down channel.

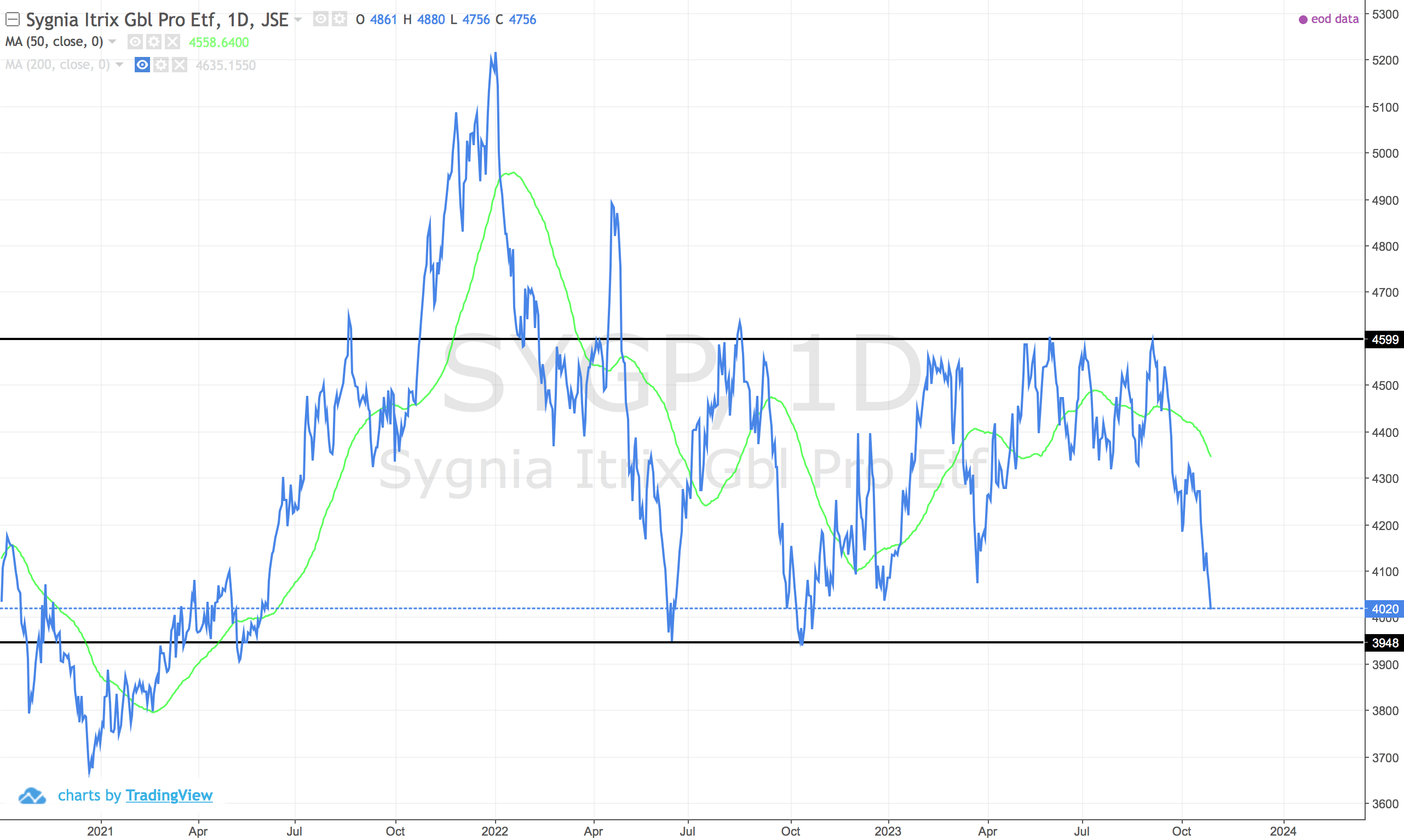

JSE:SYGP (Sygnia Global Property)

Negative break. Death cross.

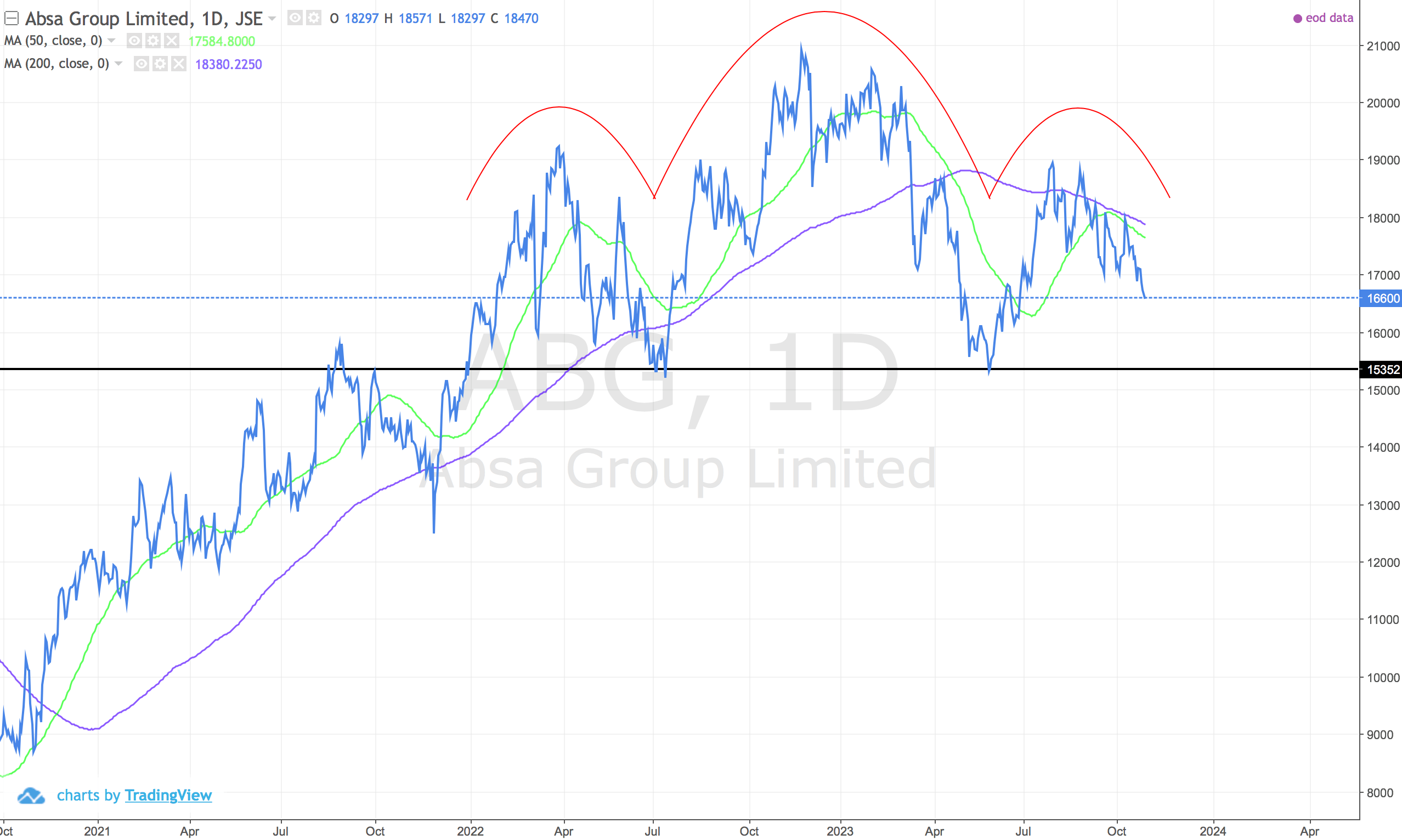

JSE:ABG (Absa)

Big head and shoulders pattern forming. Worrying.

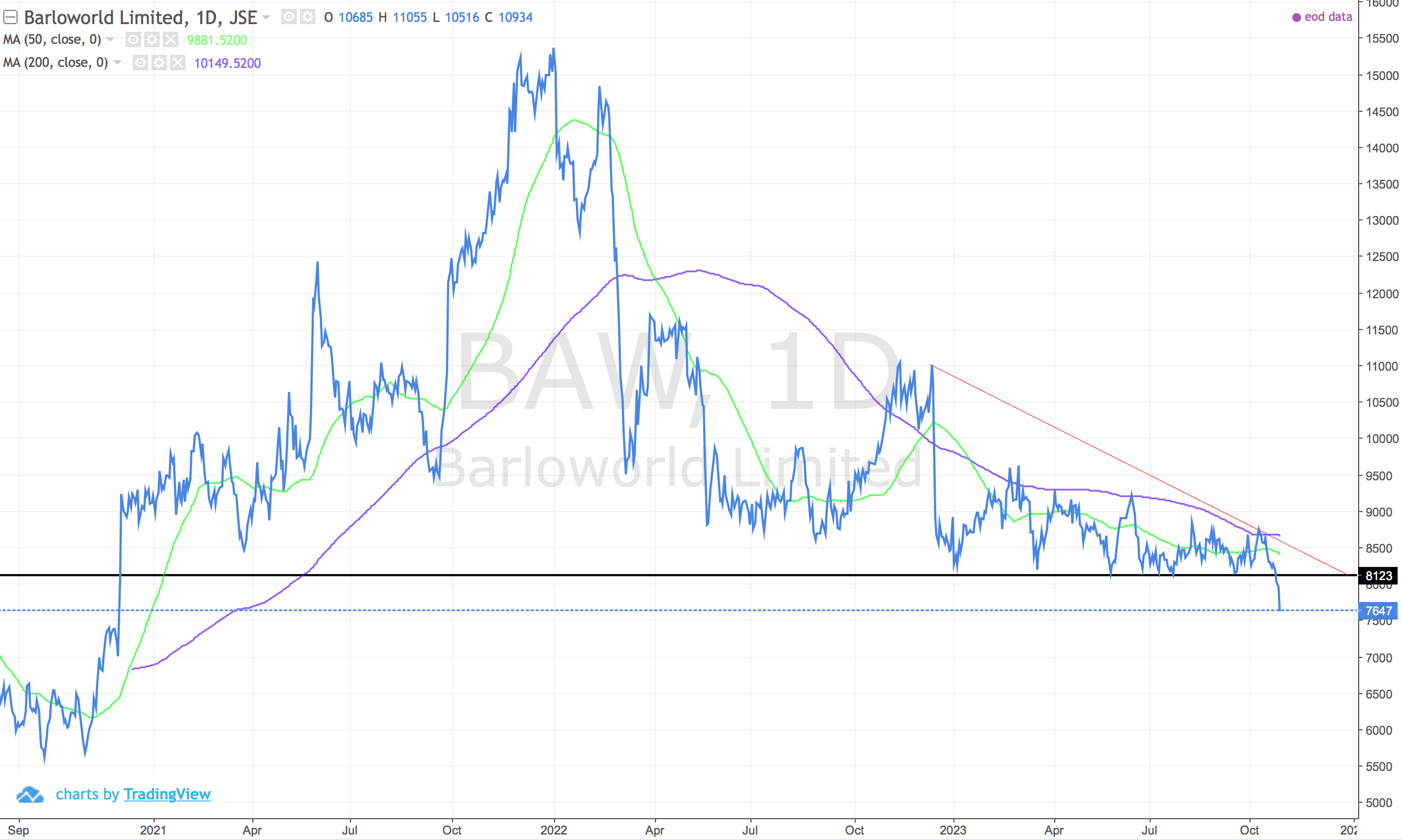

JSE:BAW (Barloworld)

Negative break. Huge head and shoulders pattern. Trending down.

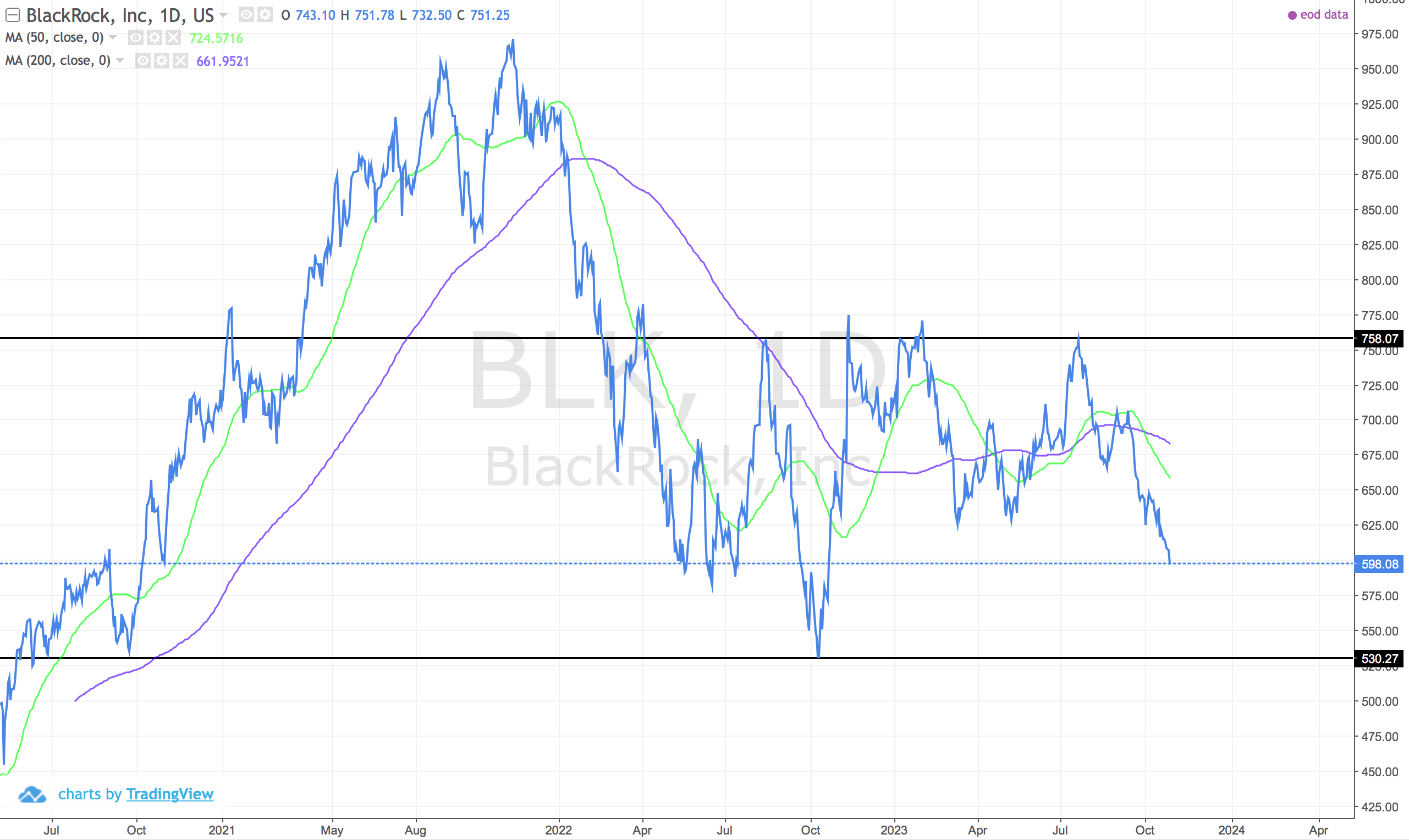

US:BLK (Blackrock)

Looks to be taking a breather for a while. Heading to $530.

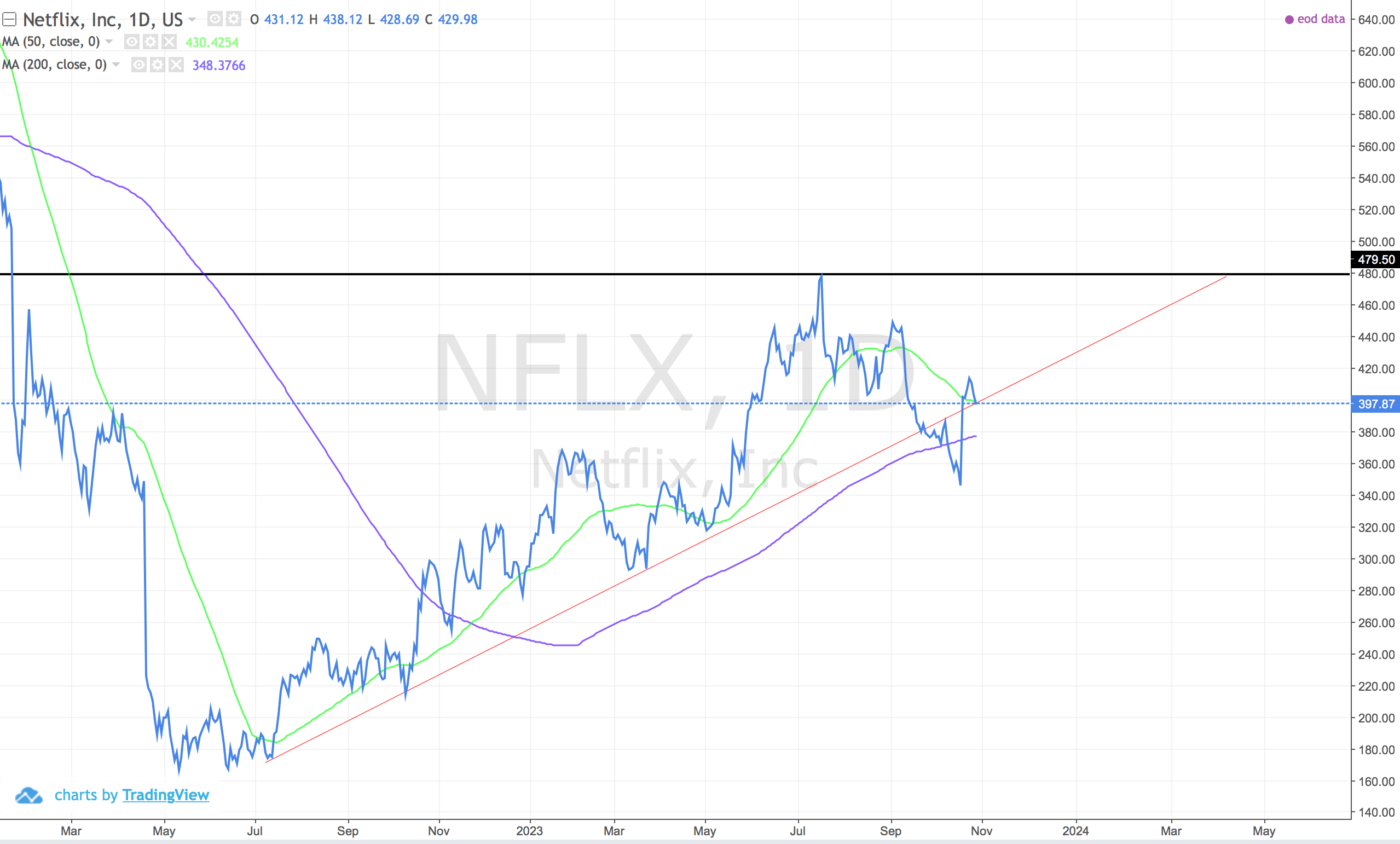

US:NFLX (Netflix)

Thought it was a kiss goodbye but results saw price jump. Still a little precarious and Needing a higher high or higher low. Only a lower low was printed.

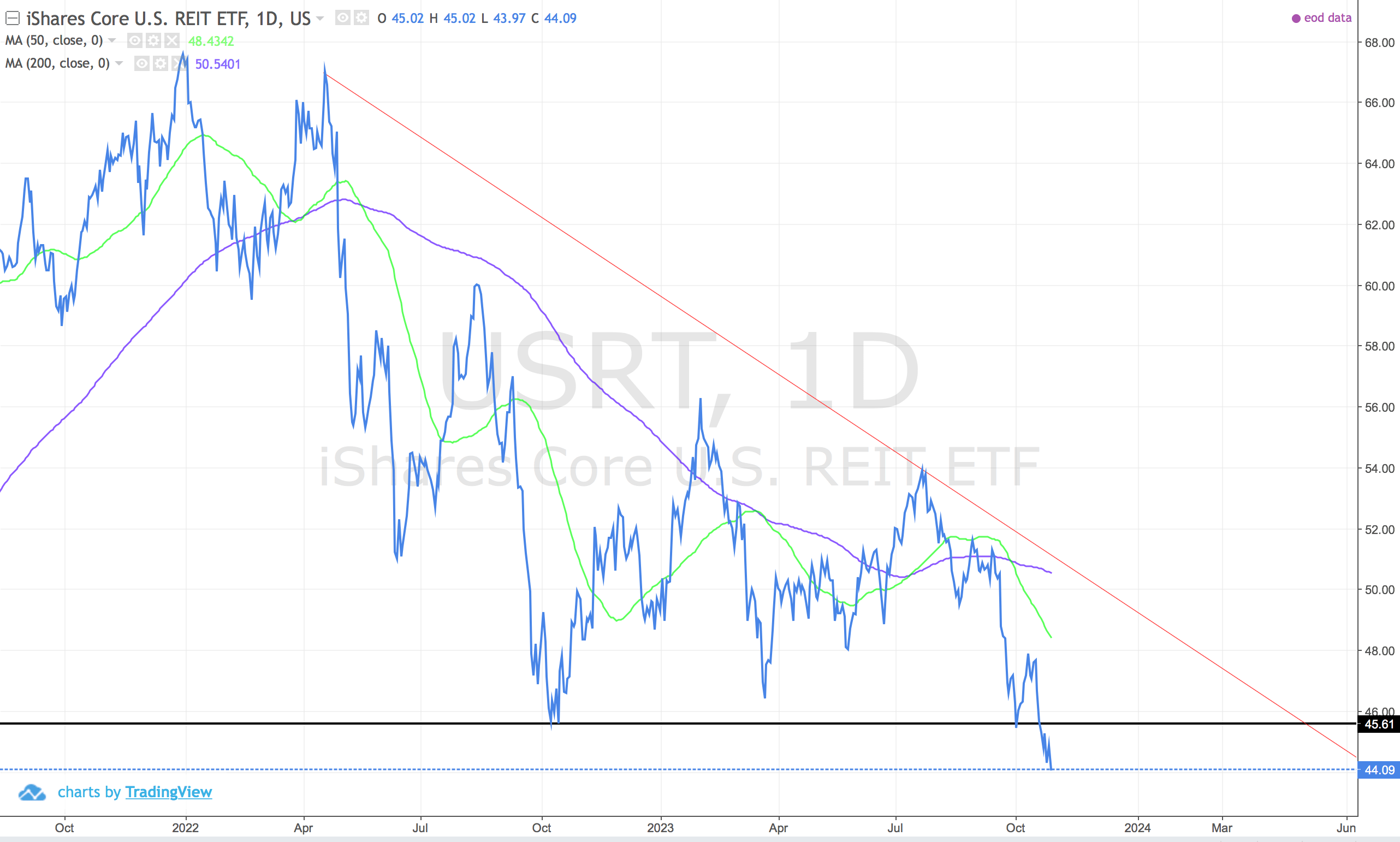

US:USRT (iShares Core US REIT)

Trending down.

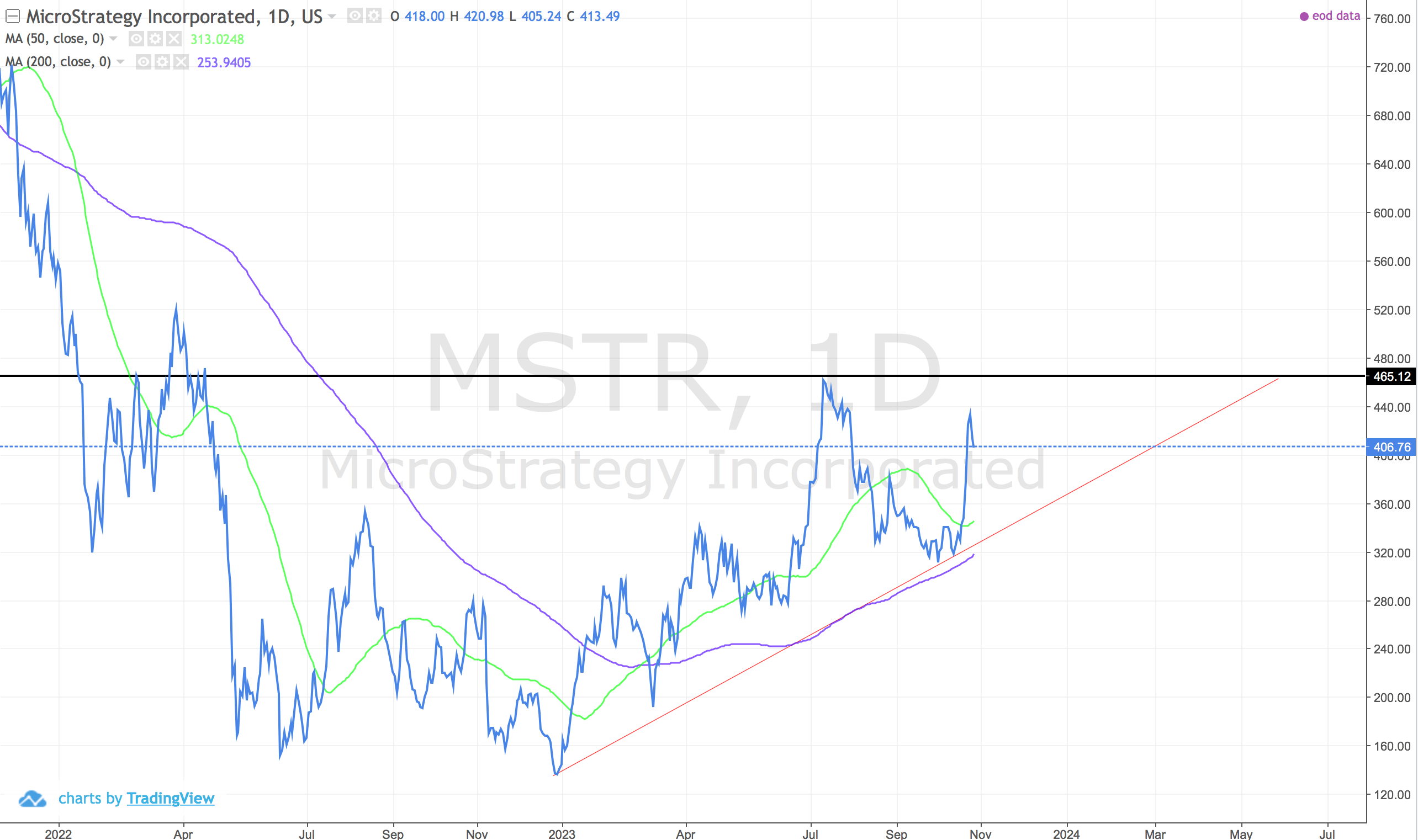

US:MSTR (Microstrategy)

Positive break. Nice base built and cup and handle being formed on the uptick in bitcoin price. Trend is up.

US:AR (Antero Resources)

Positive break. Cup and handle. Golden cross. Looking decent.

US:AMD (AMD)

Ugly looking downward channel.

US:JNJ (Johnson and Johnson)

Negative break. Broken from a big top pattern.

US:ZM (Zoom Video Communication)

Descending triangle. Trending down. Huge loss of value.

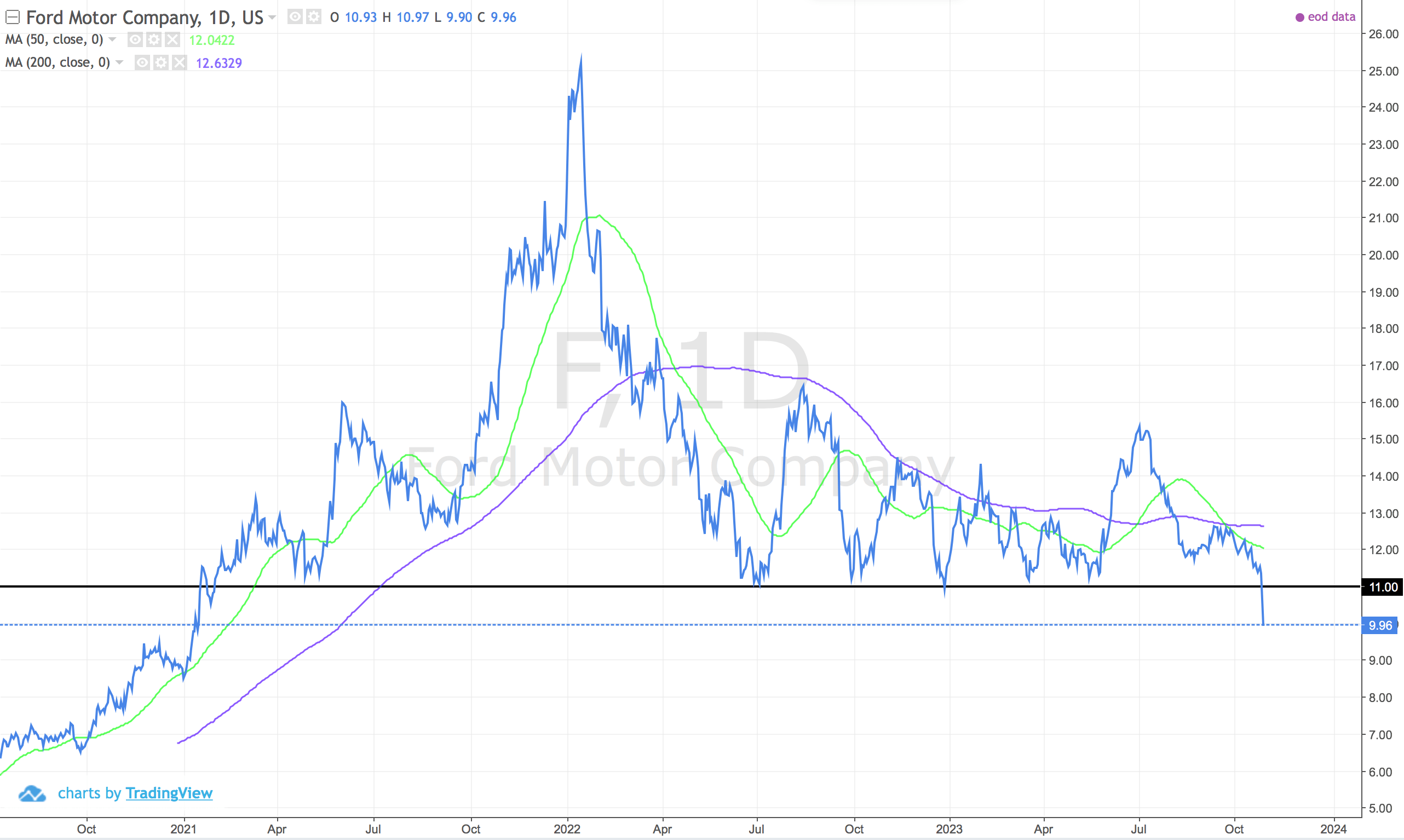

US:F (Ford)

Negative break. Trending down. Horrible looking chart. A shoulder, head and multiple shoulders. Projects down to zero - unlikely to happen.

Comments ()