Taking Stock: 16 November 2020

Looking at a SP500, a couple of stocks, USDZAR, Gold and Bitcoin

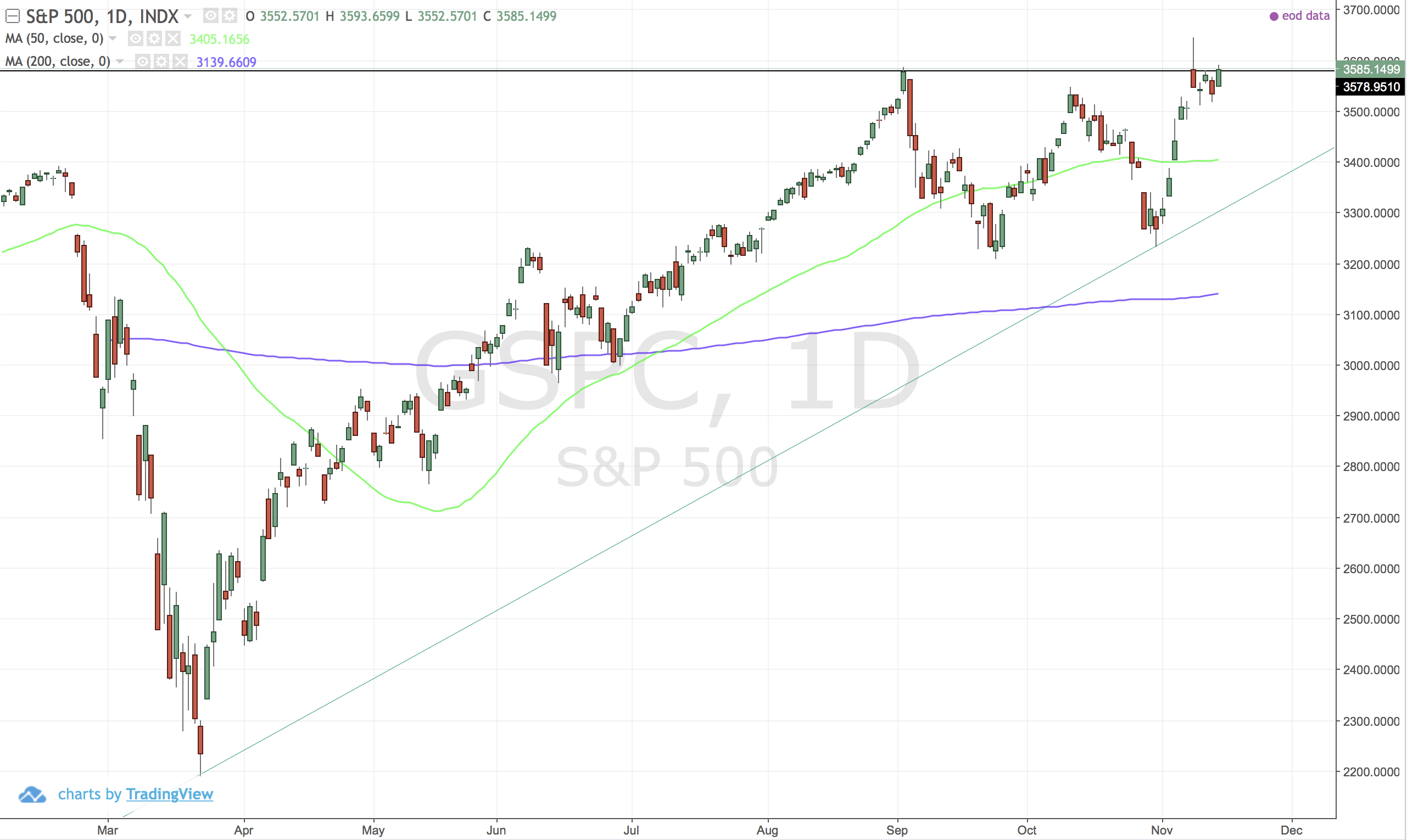

GSPC (SP500)

Ascending triangle breakout. More upside coming - well that's the idea.

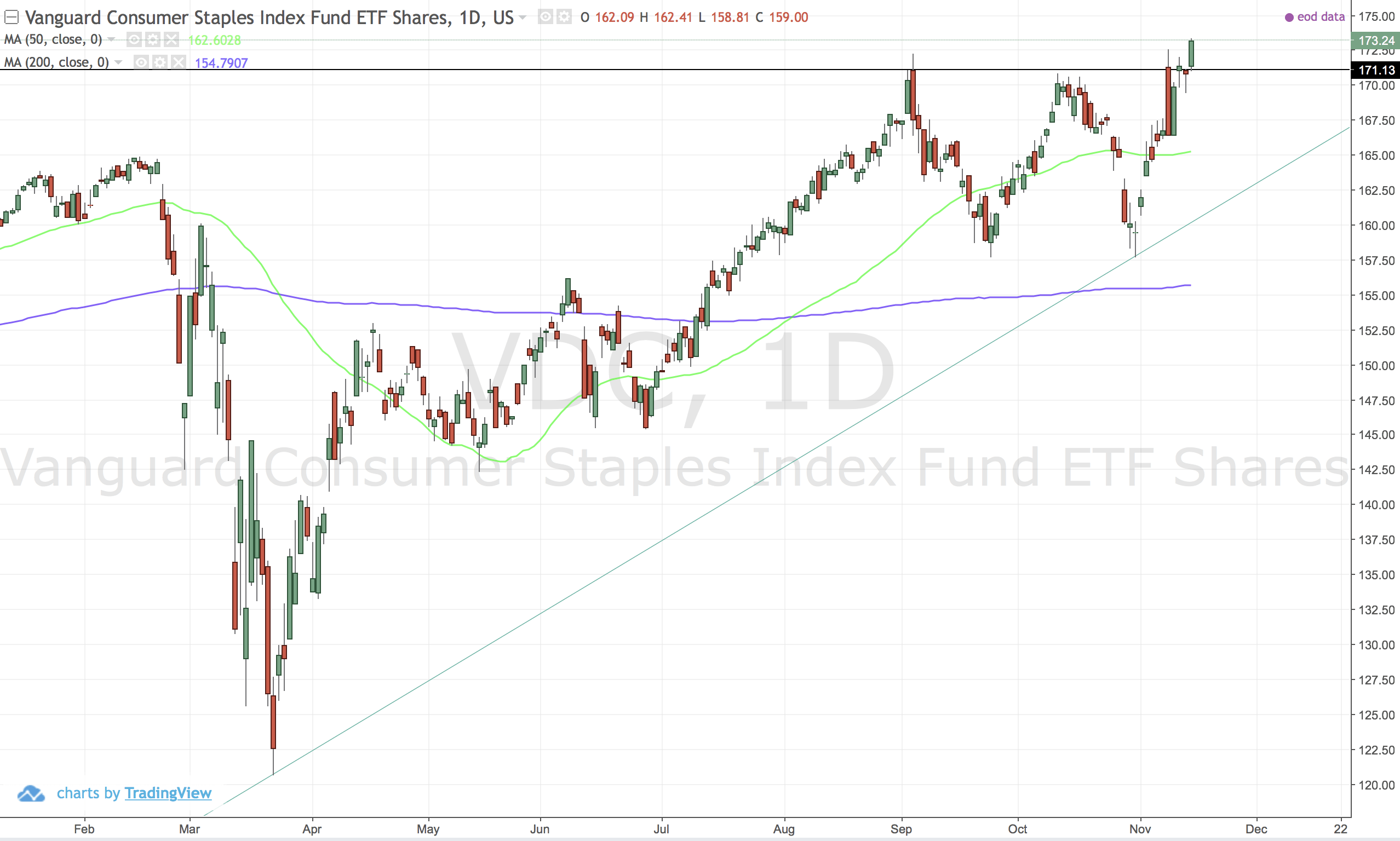

US:VDC (Vanguard Consumer Staples ETF)

Ascending triangle breakout.

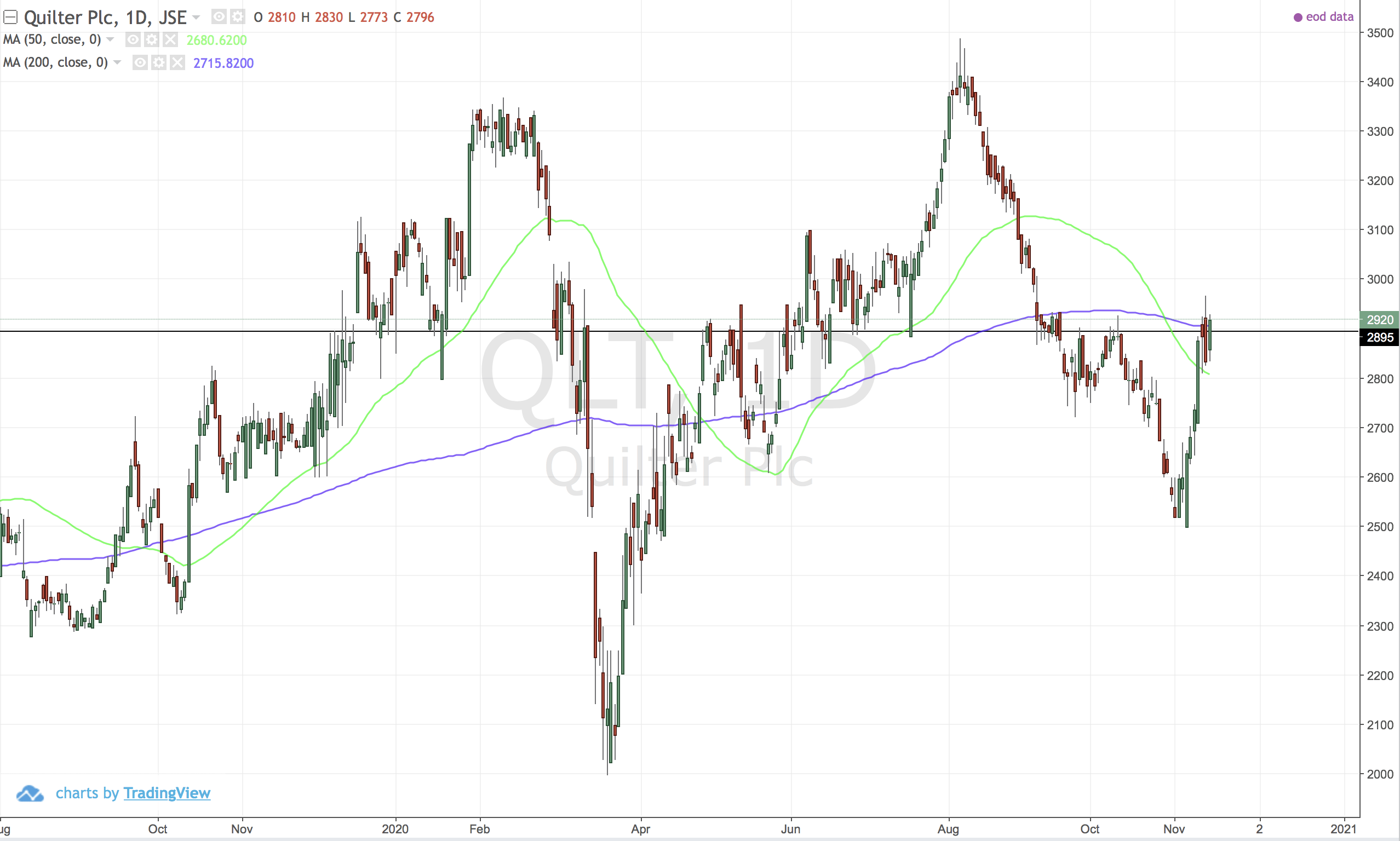

QLT (Quilter)

Long term trend is up, it looks a bumpy ride though.

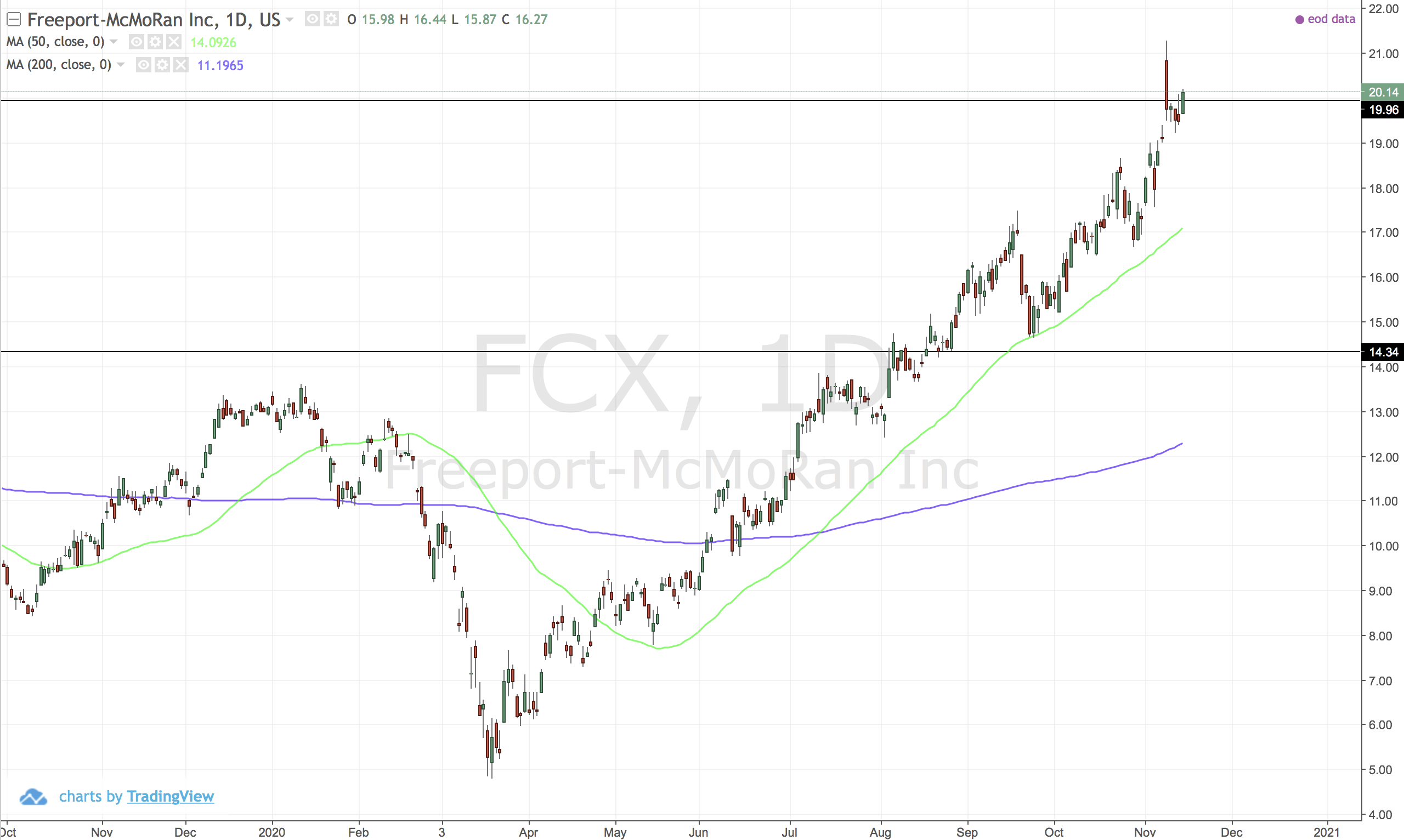

US:FCX (Freeport-Moran)

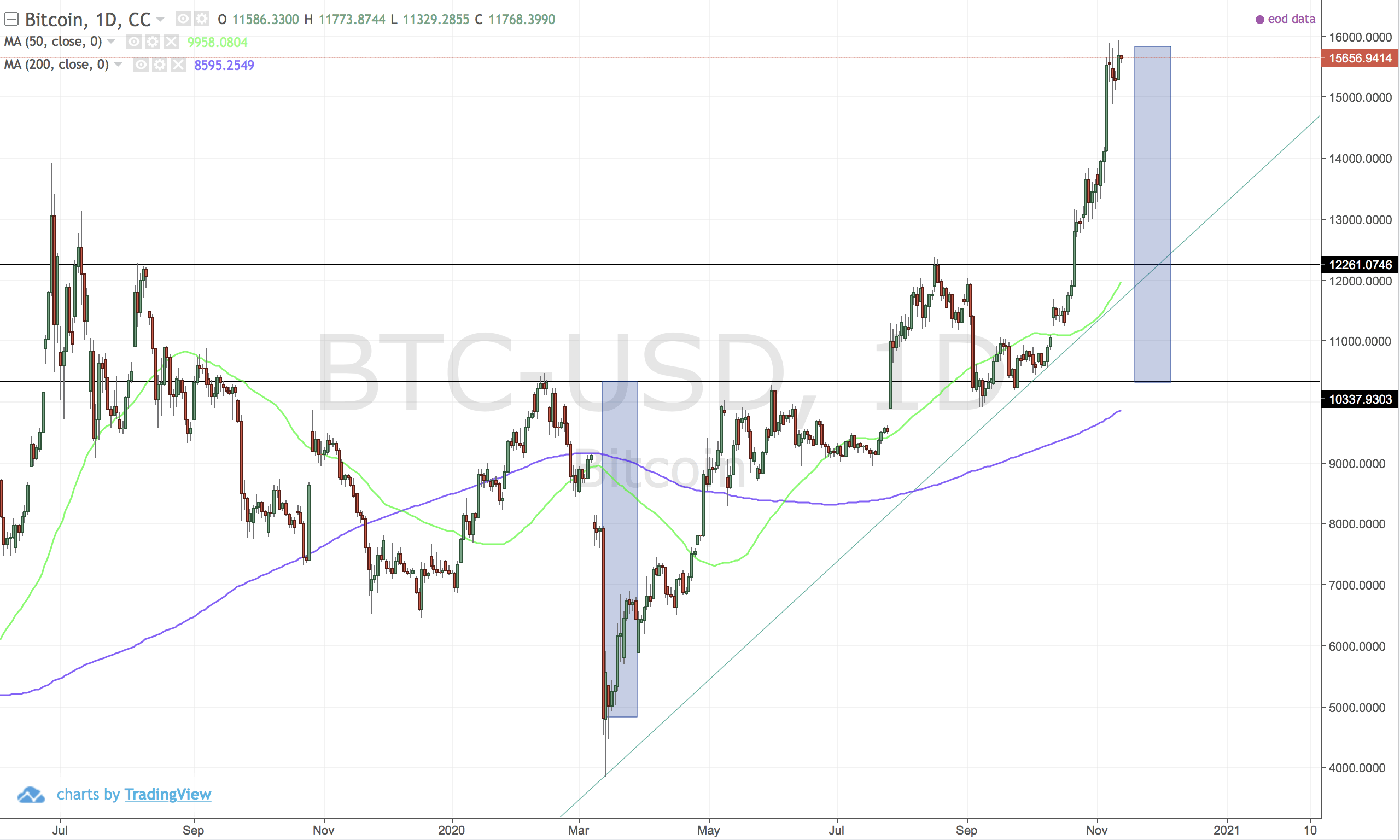

BTCUSD (Bitcoin in Dollars)

Reached the projection of the inverse head and shoulders pattern. I am looking for a mean reversion to the trendline to enter.

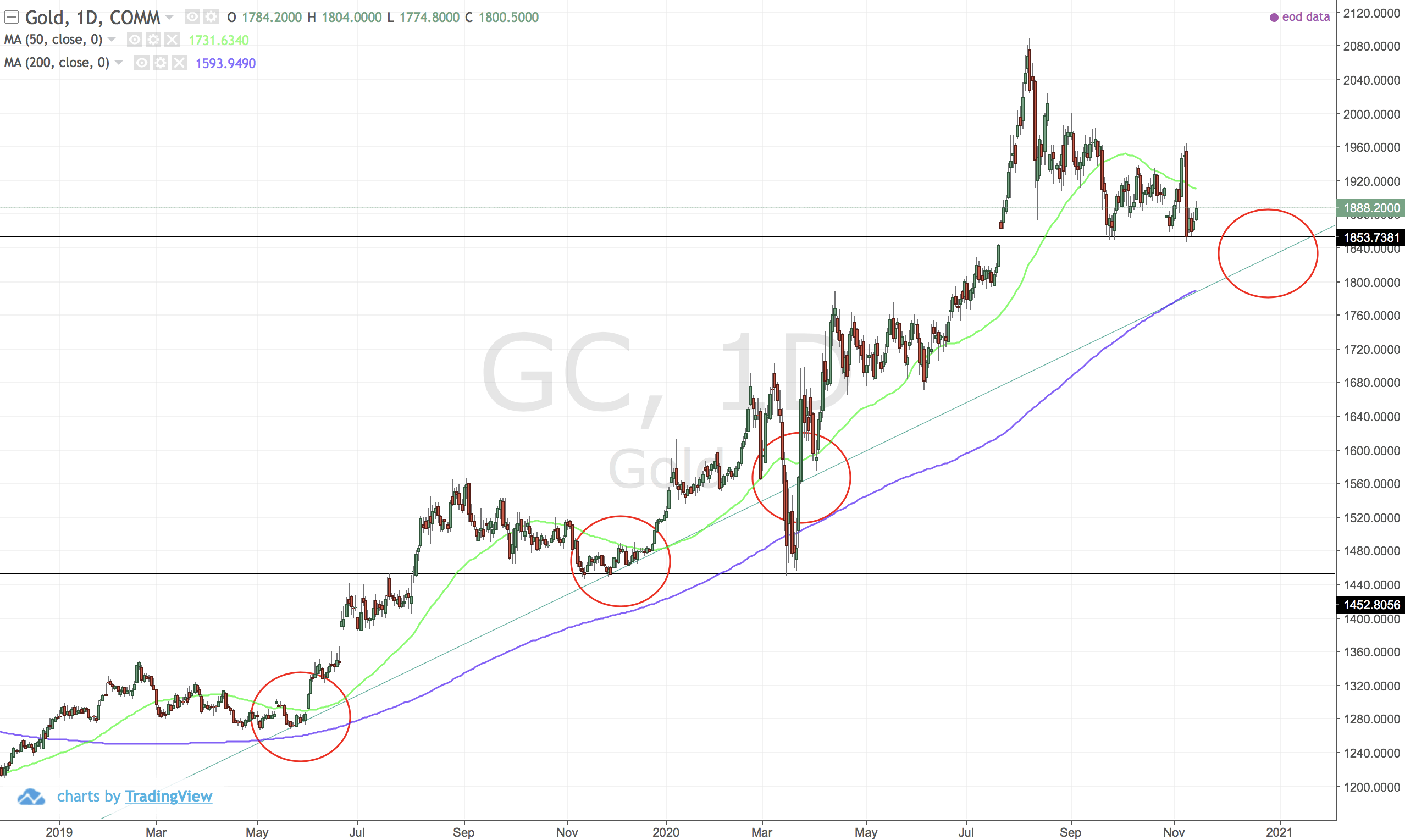

GC (Gold)

Long term up trend. Is it time to reload on gold?

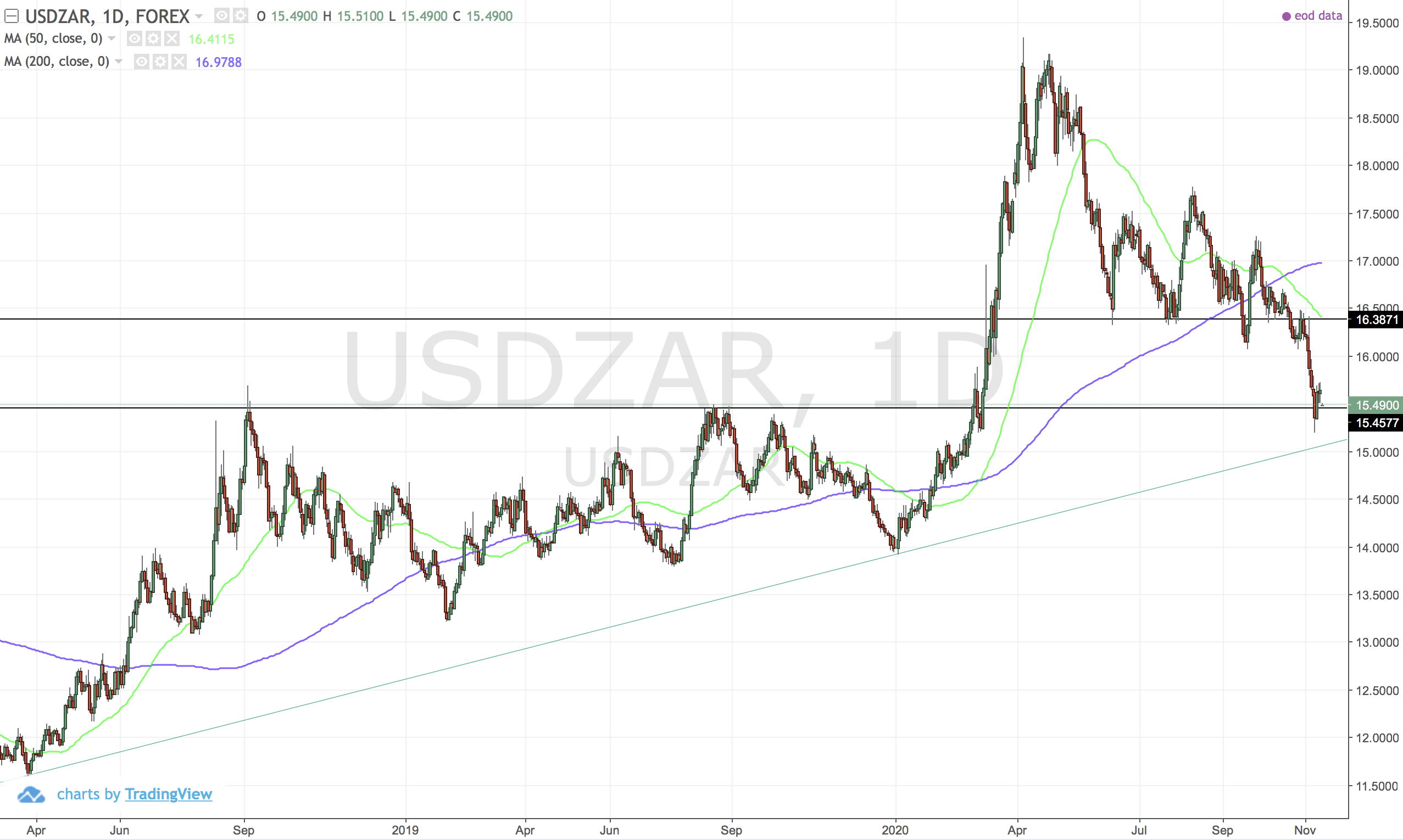

USDZAR

In an area with lots of support.

Comments ()