Breakouts: 06 November 2020

I take a look at Napsers, Dischem, some ETFs on US markets, Google and Eldorado Mining.

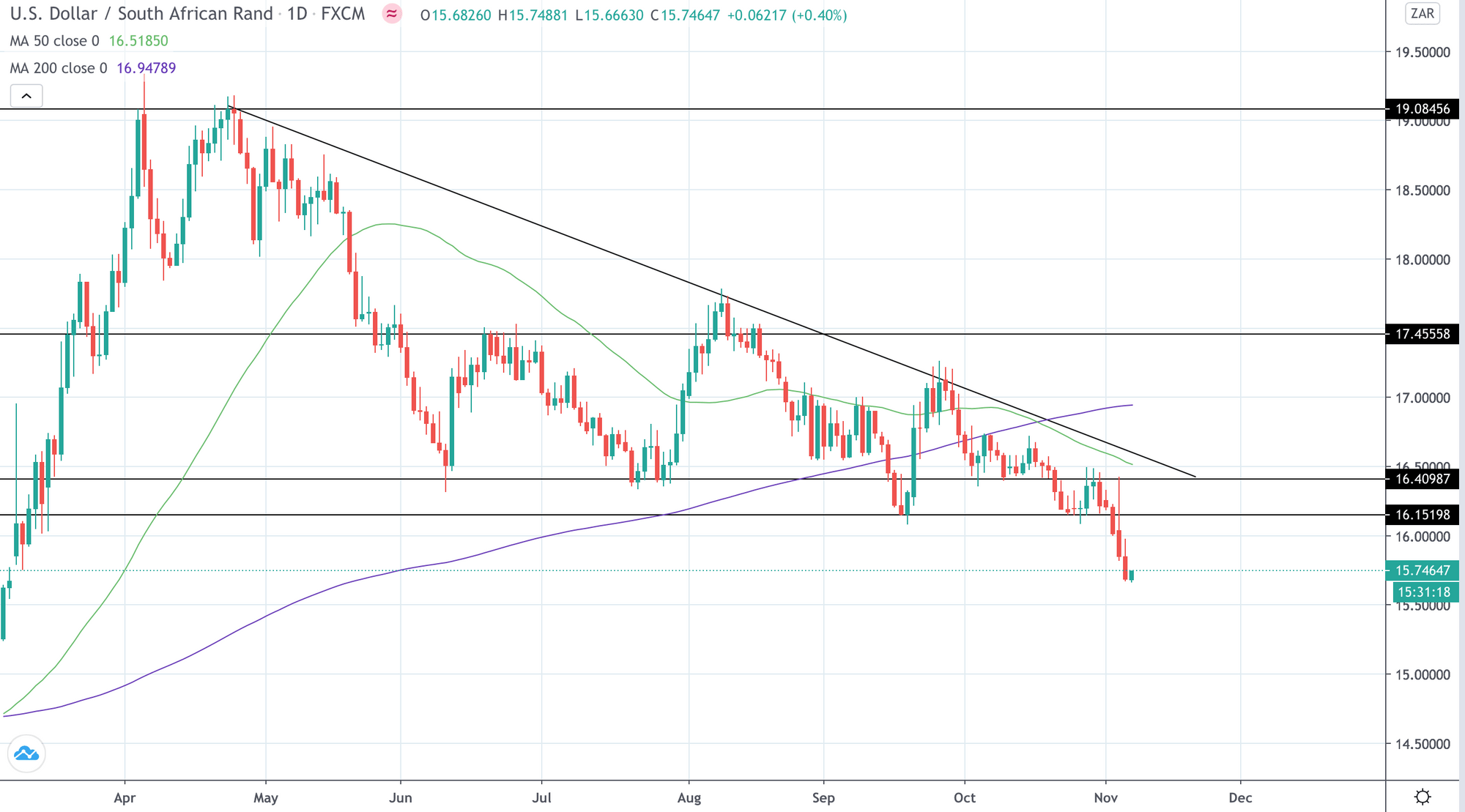

USDZAR

Big break lower forming a channel or wedge.

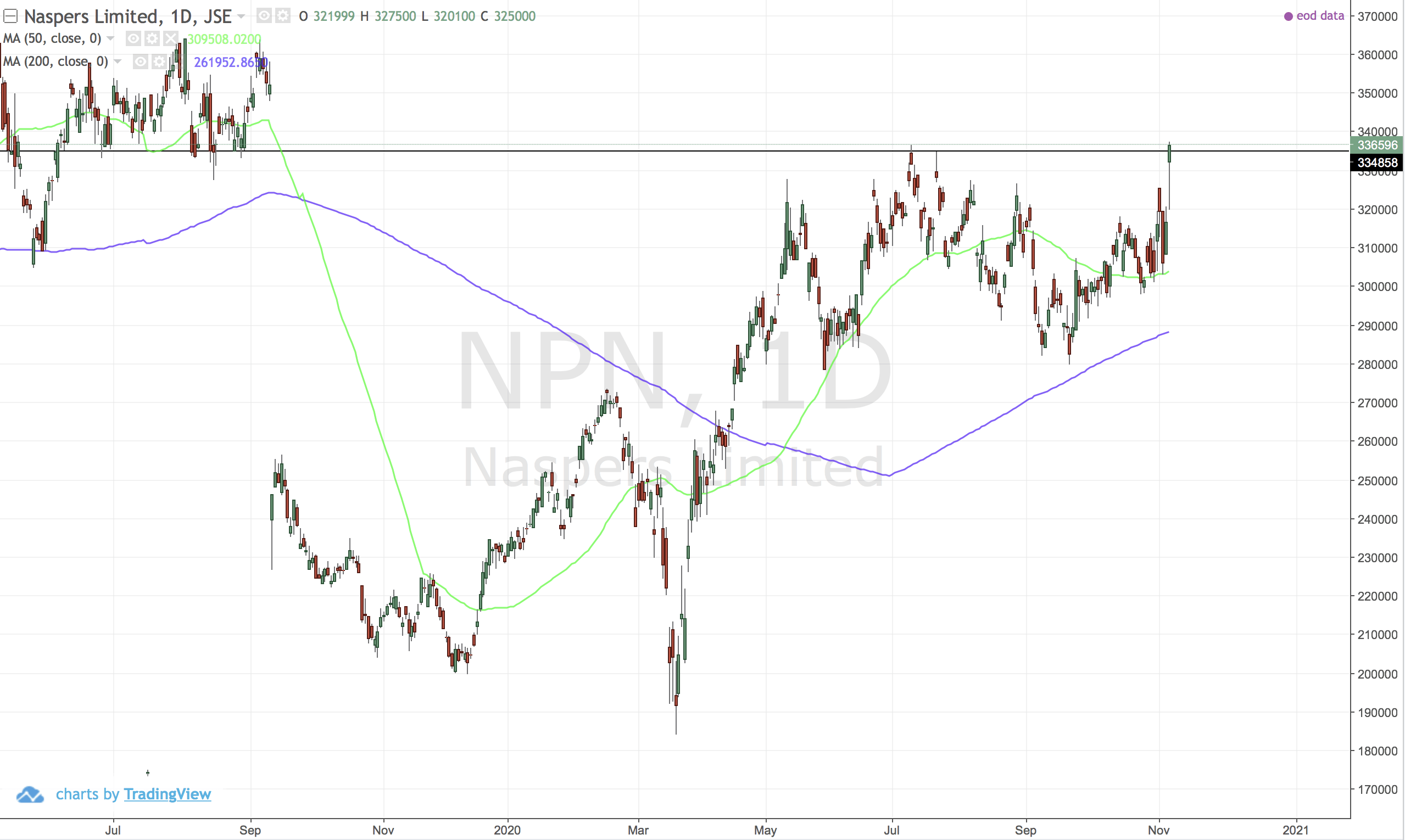

NPN (Naspers)

Break above the horizontal resistance.

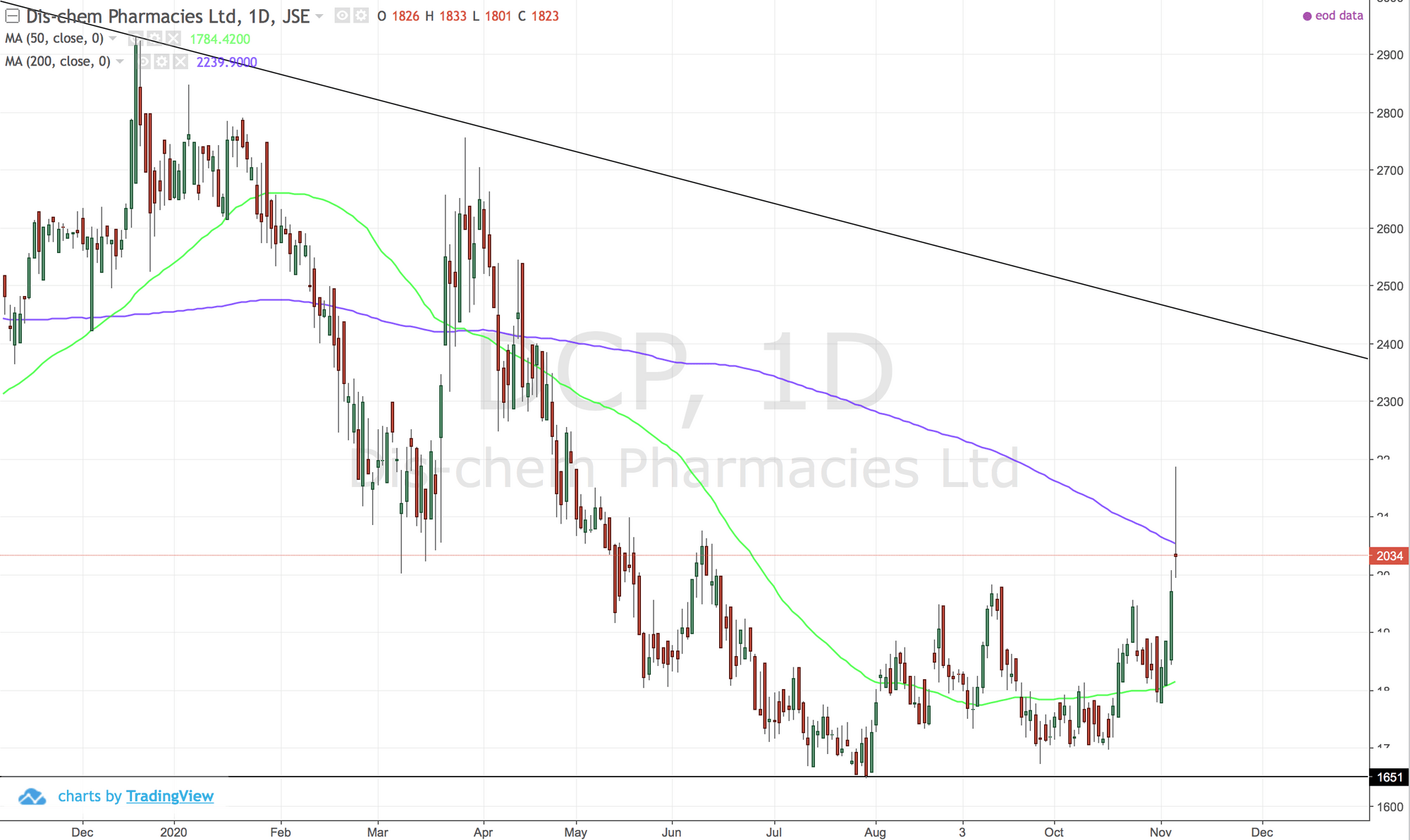

DCP (Dischem)

A weird candle on this upward break. Long term trend is still strongly down.

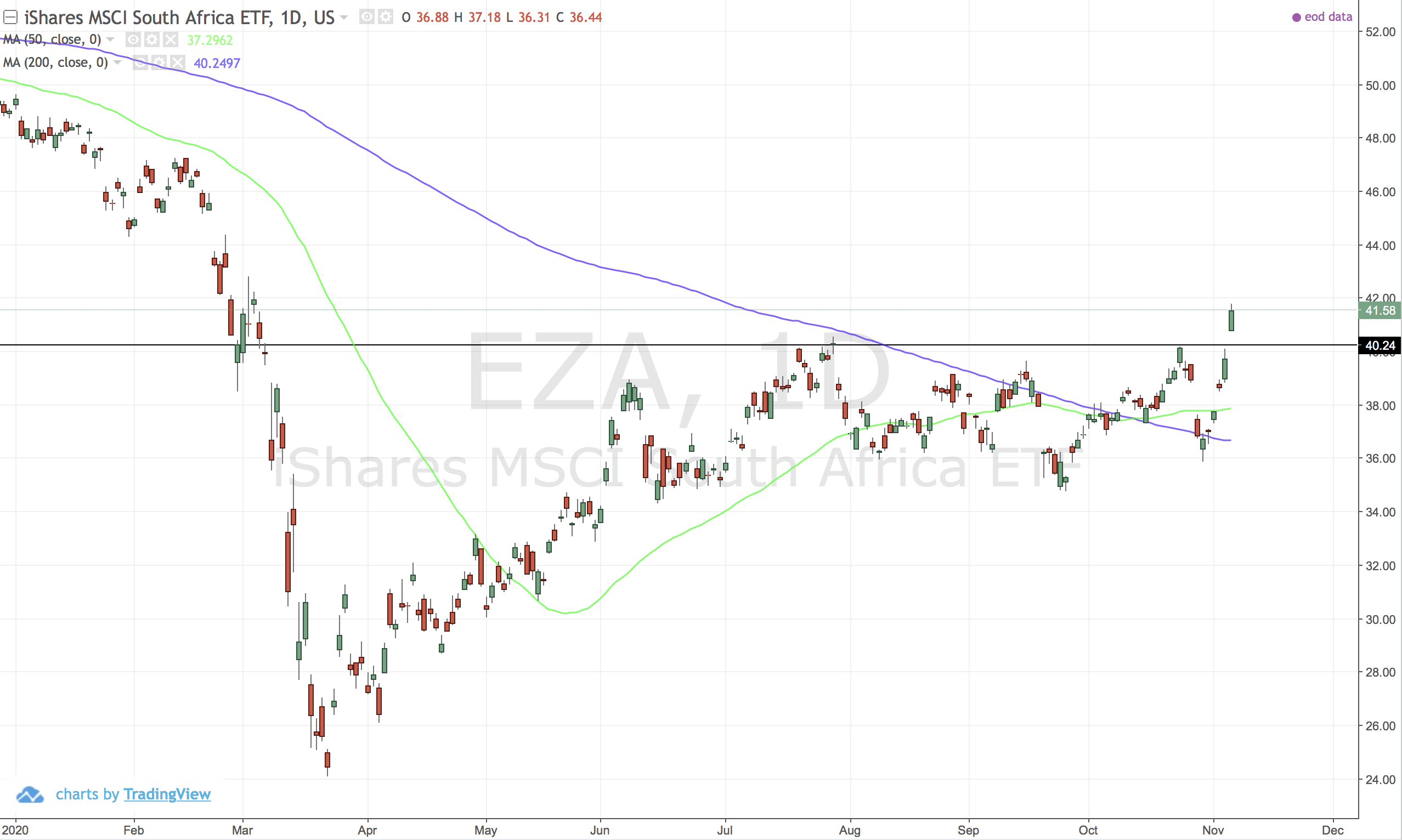

US:EZA (iShares South Africa ETF)

Cup and handle breakout and a golden cross. Dollars currency woes look to be helping this chart.

Constituents:

- 24.77%: Naspers (NPN)

- 5.3%: First Rand (FSR)

- 4.6%: Anglogold (ANG)

- 4.5%: Goldfields (GFI)

- 4%: Standard Bank (SBK)

- 3.5%: Impala (IMP)

- 3.3%: Sibanye-stillwater (SSW)

- 3%: MTN (MTN)

- Many others...industrials, other miners

The ETF has chosen decent sectors to be heavy weight on. Local industrials are not very prominent in this list.

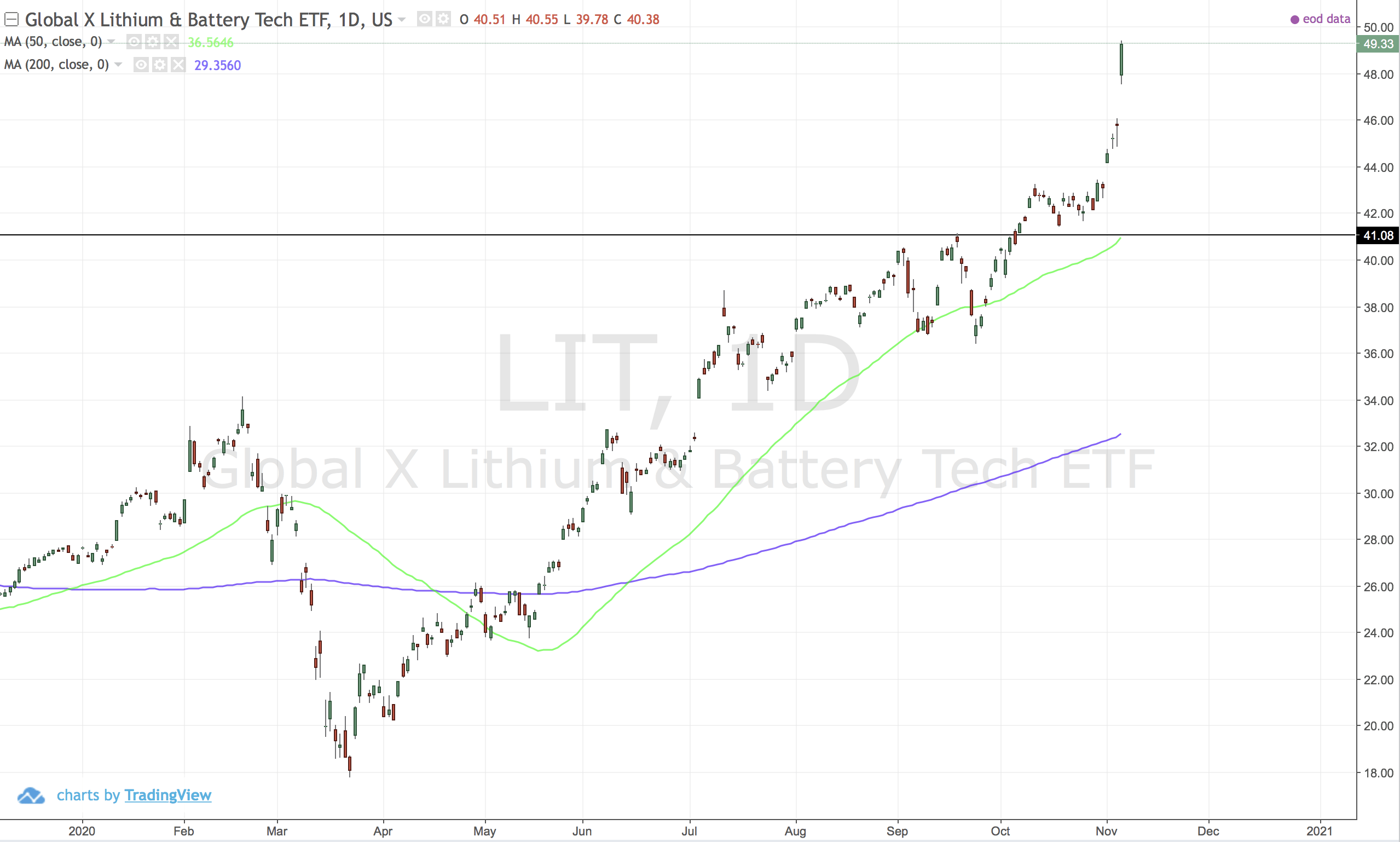

US:LIT (Global Lithium and Battery ETF)

Rocketing now. I missed a good entry.

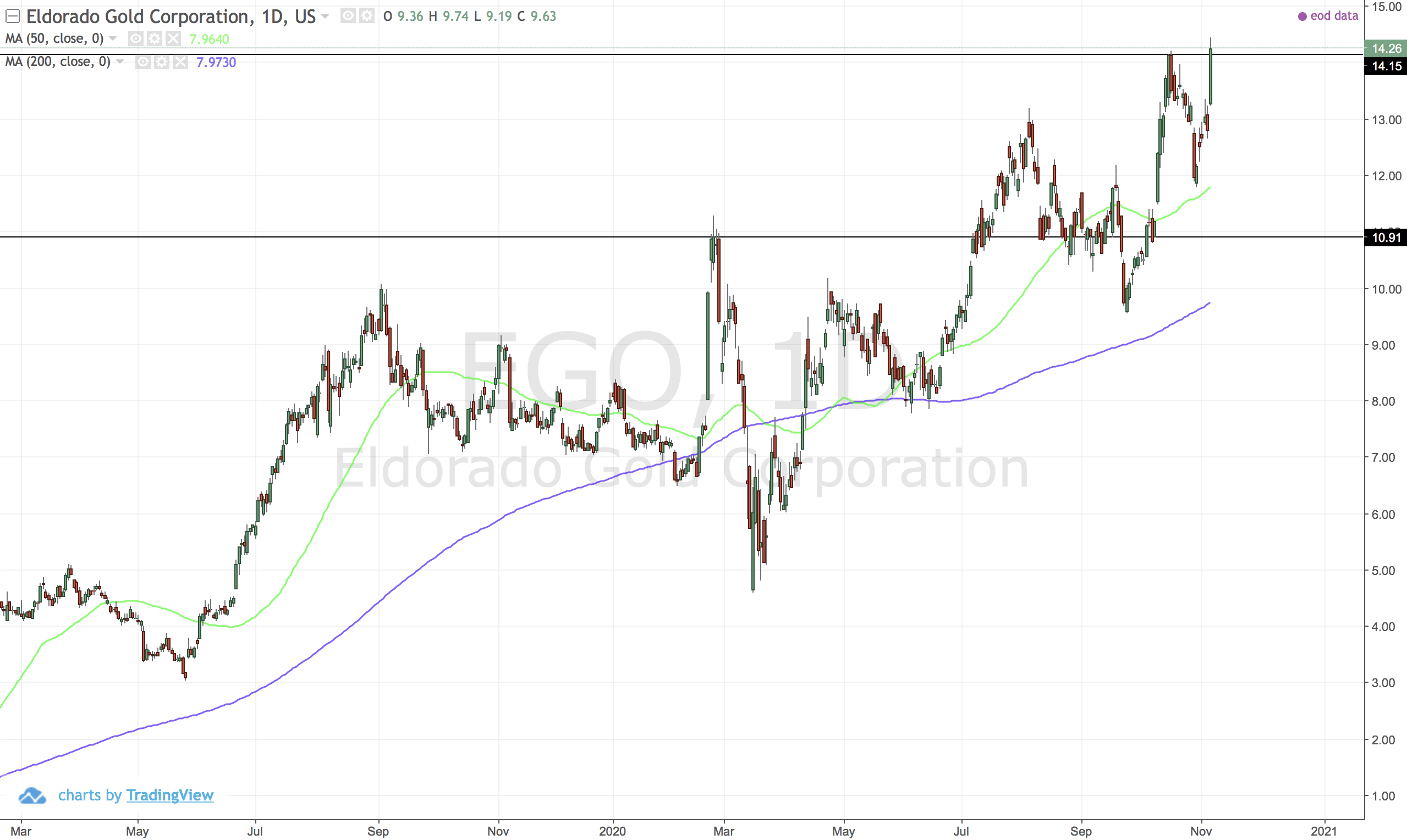

US:EGO (Eldorado Gold Corporaction)

Strong up trend and a new high. All is looking good.

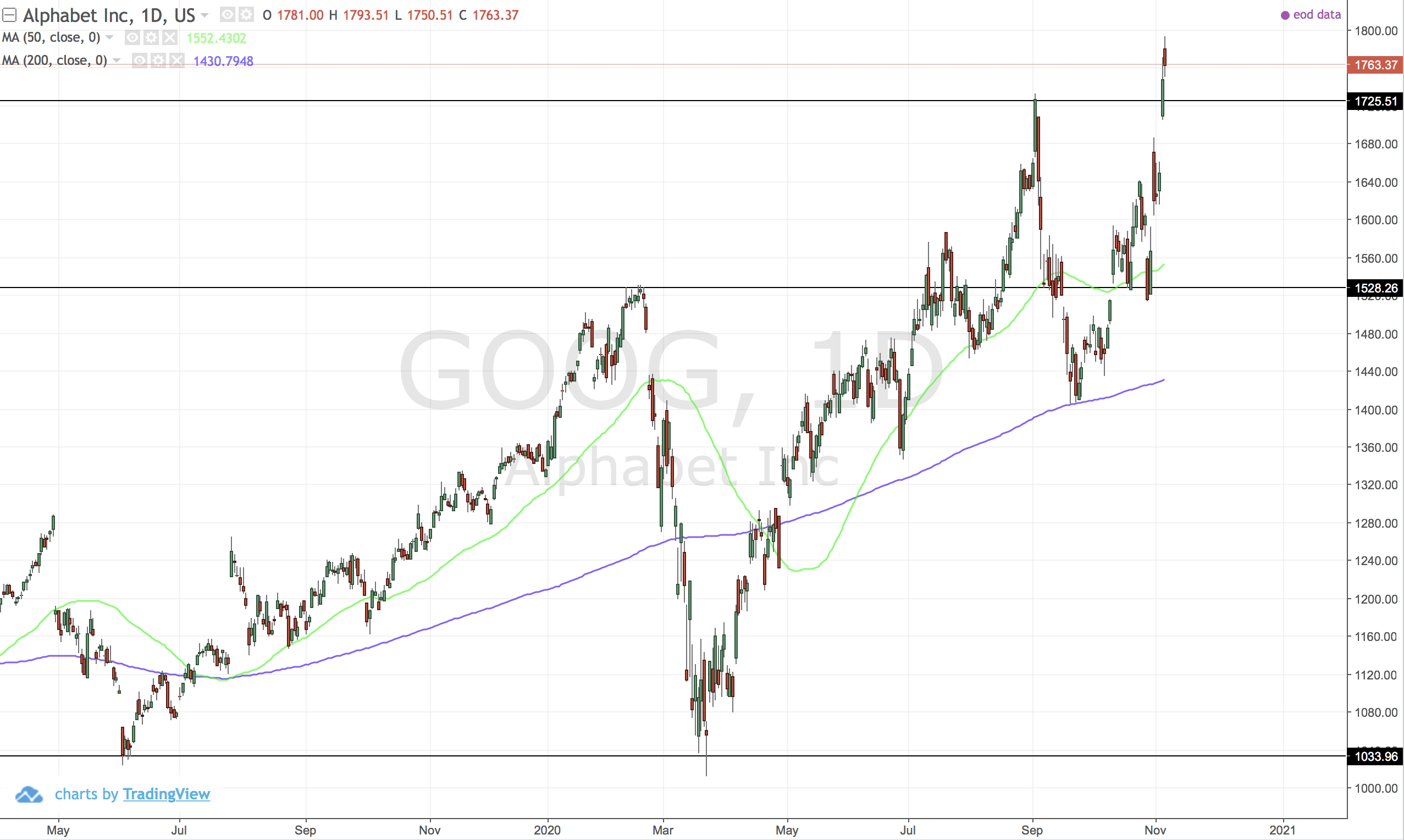

US:GOOG (Google)

Break-up. Looking strong.

Comments ()