Breakouts: 05 January 2022

A look at breakouts in British American Tobacco, Remgro, ANH, Bidcorp,Satrix Nasdaq ETF, Old Mutual, Master Drilling, Hulamin and US stock Zoom.

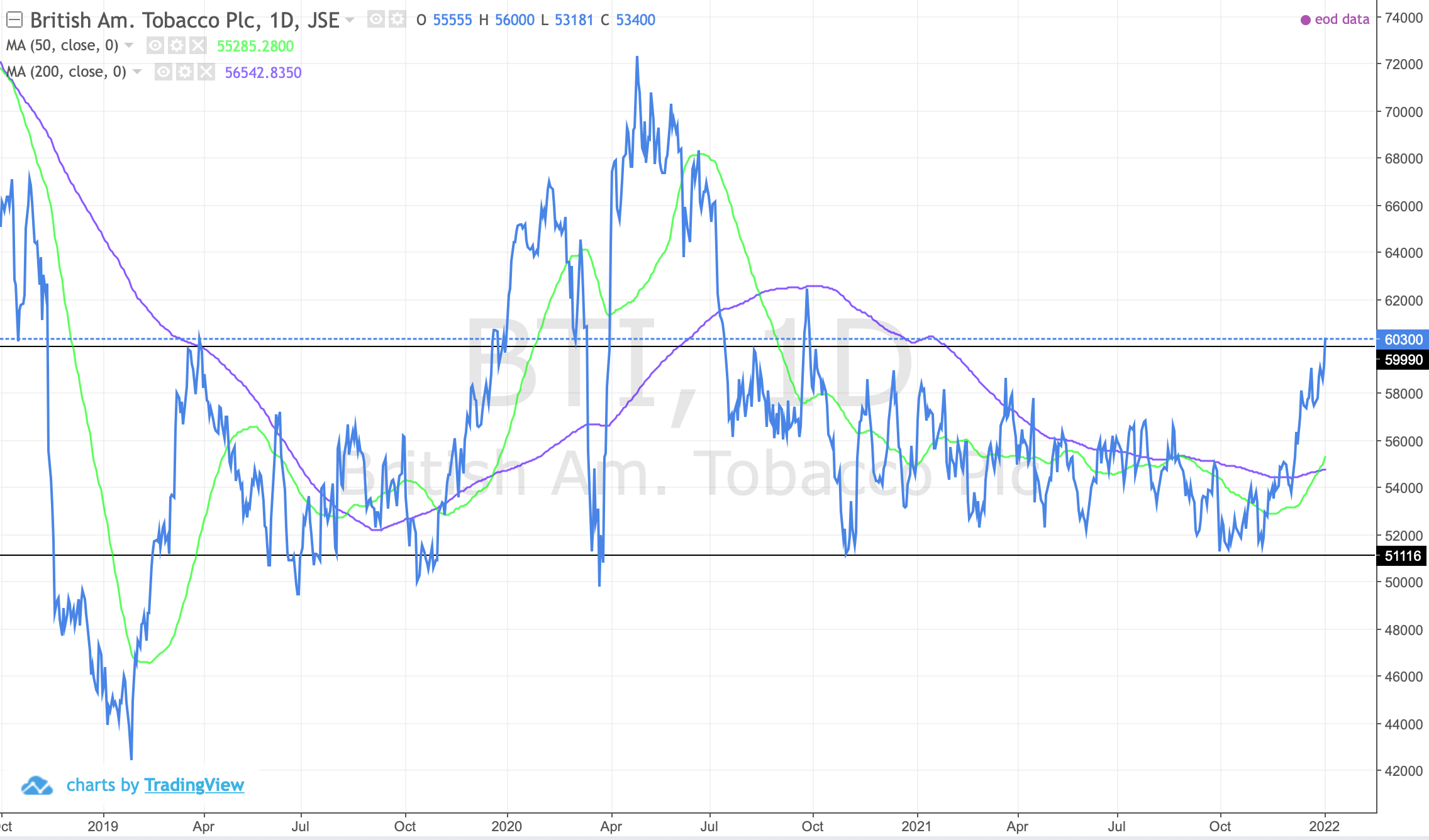

JSE:BTI (British American Tobacco)

Positive break. At the top of the sideways channel. Golden cross - the 50MA has moved above the 200MA. Will this be a sustained move or will the channel prove harder to breakout of?

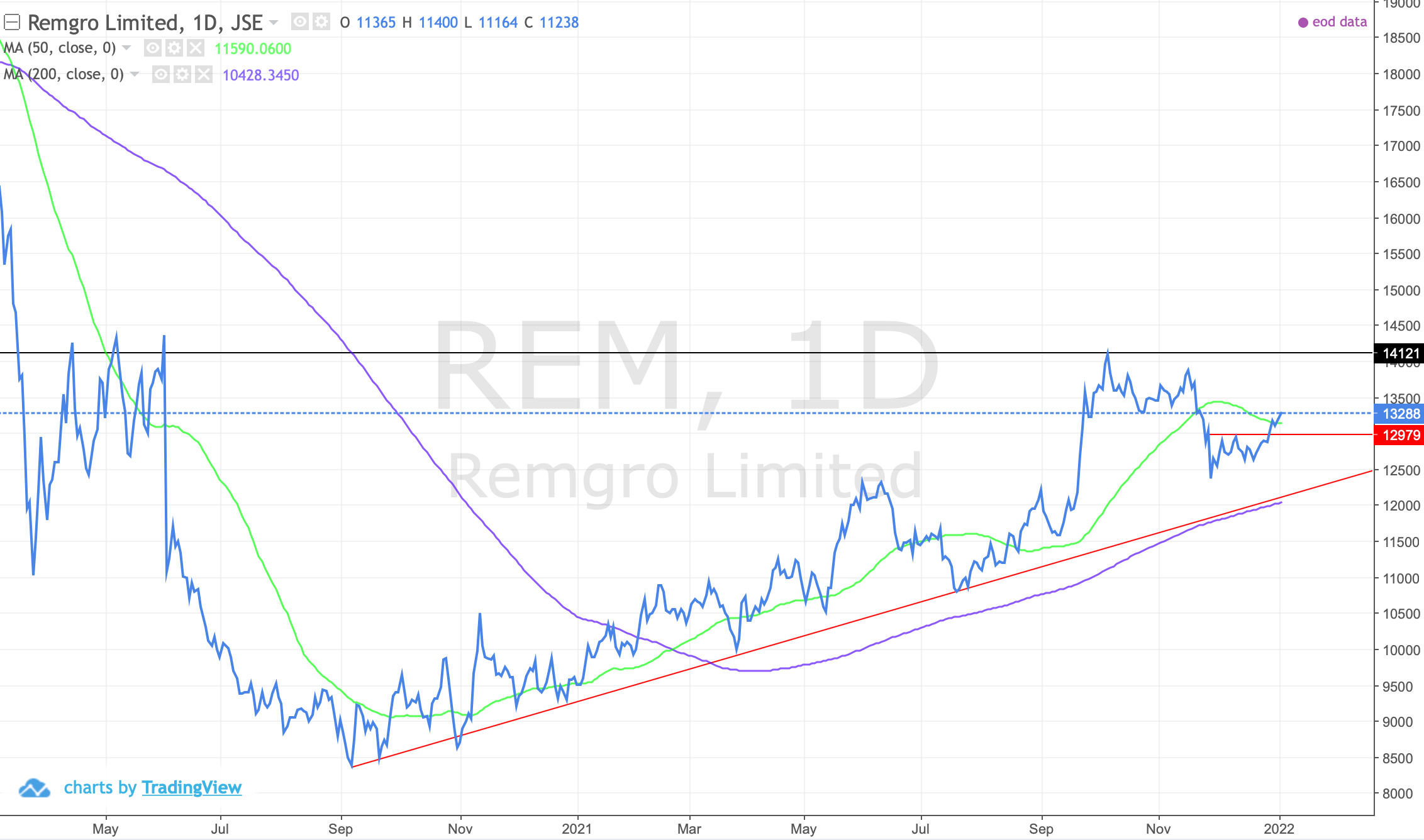

JSE:REM (Remgro)

Positive break. Targeting a break above the cup and handle lip line at 14121.

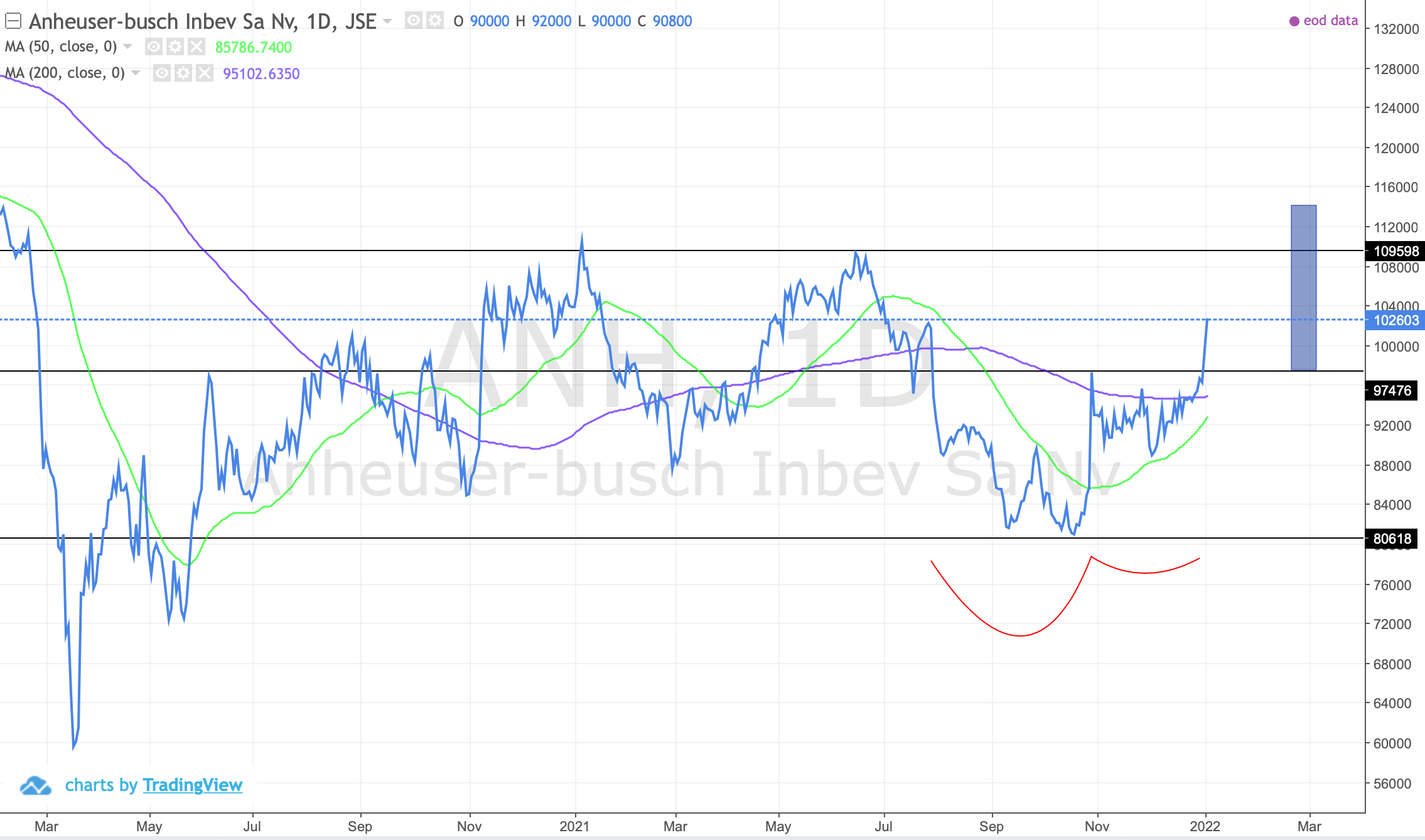

JSE:ANH (Inbev)

Positive break. out of a cup and handle pattern. The target is 114000. It is still trapped in a sideways channel but price action gives the signs of upward momentum.

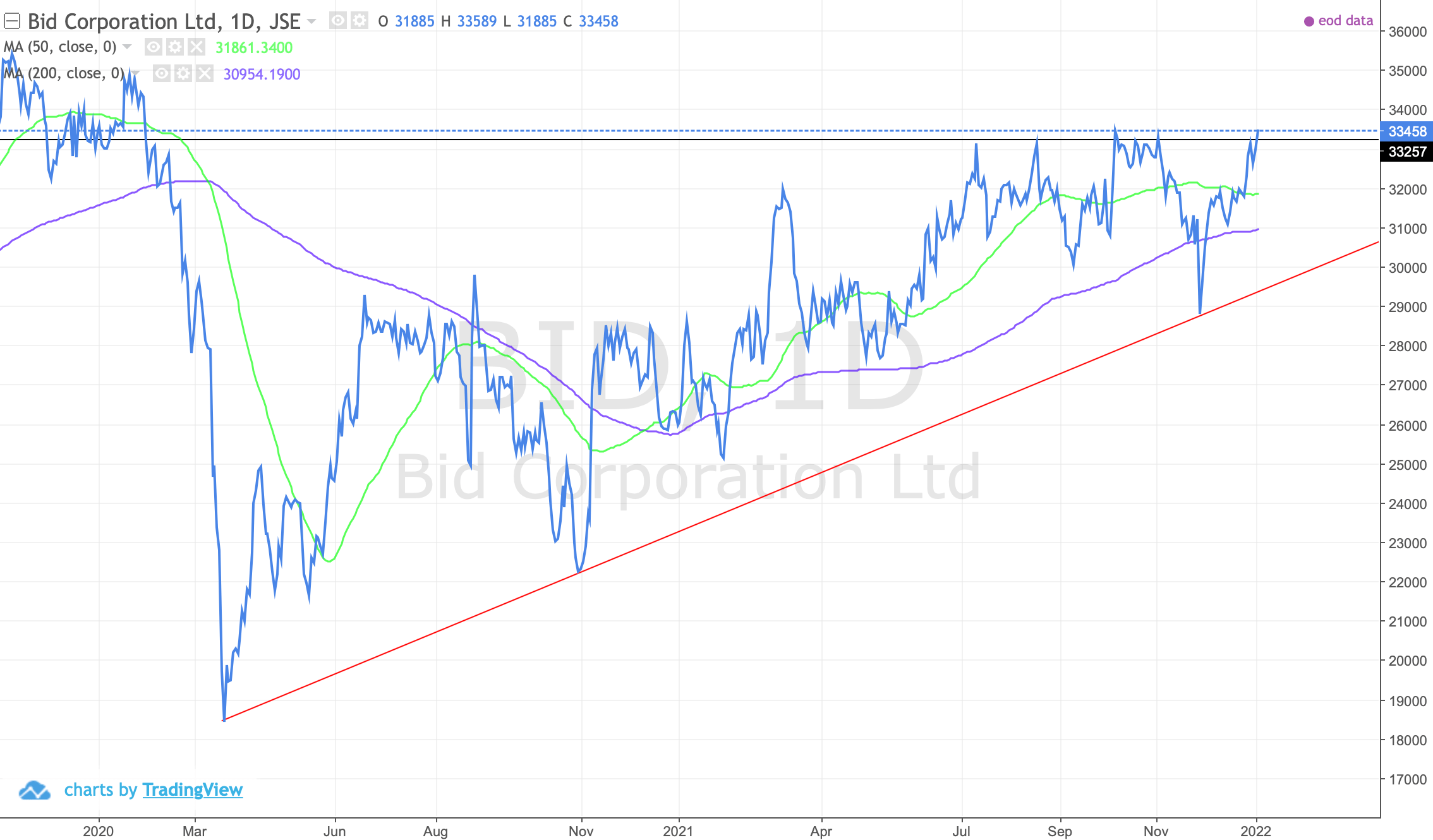

JSE:BID (Bidcorp)

Positive break. The trend line fits really well and gives us an idea of where draw-downs will end up. We are finally looking at a break of the ascending triangle - after a dip - and a sustained upward move.

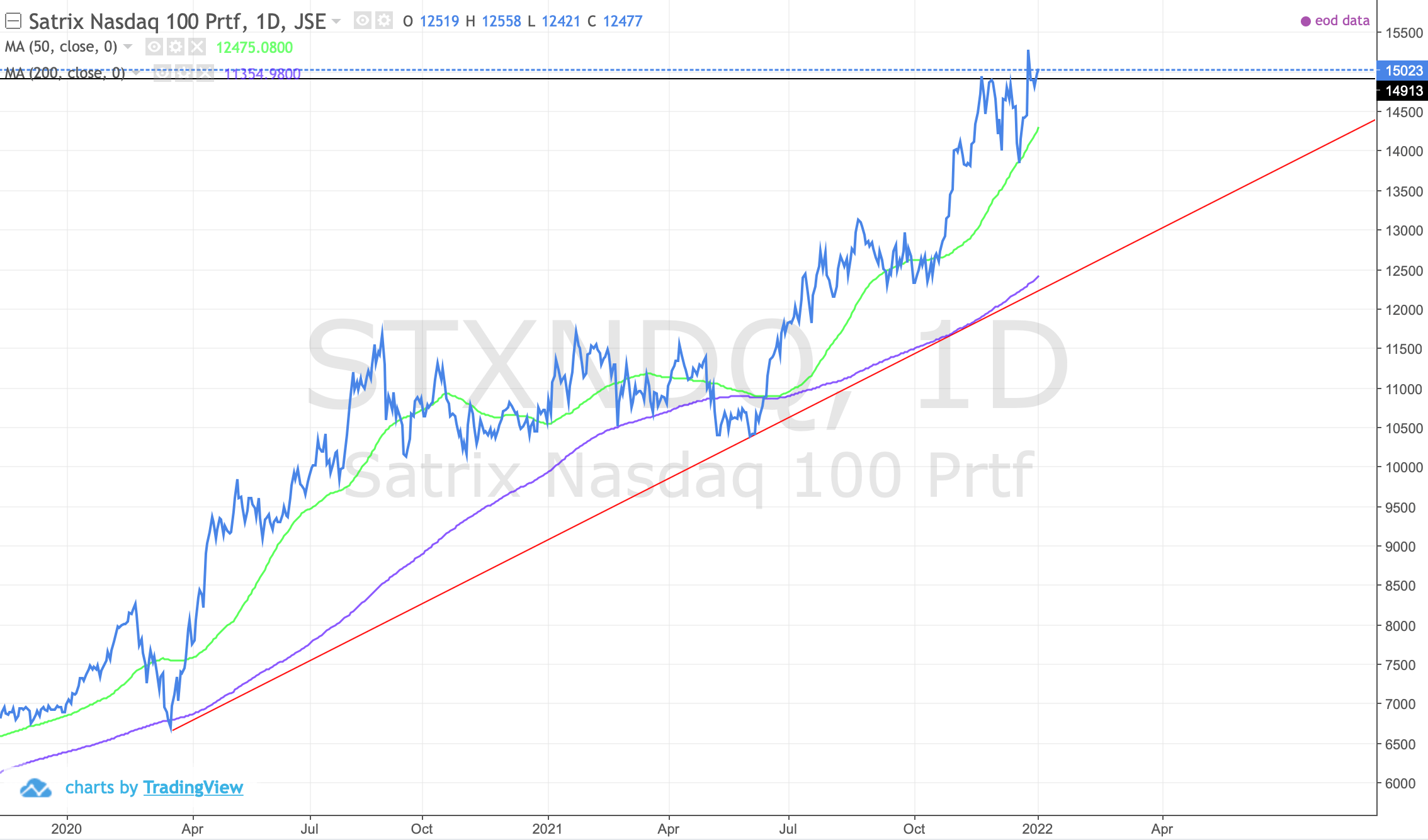

JSE:STXNDQ (Satrix Nasdaq ETF)

Positive break above the 15000 level. Be wary though the space exiss for a move back to the trendline.

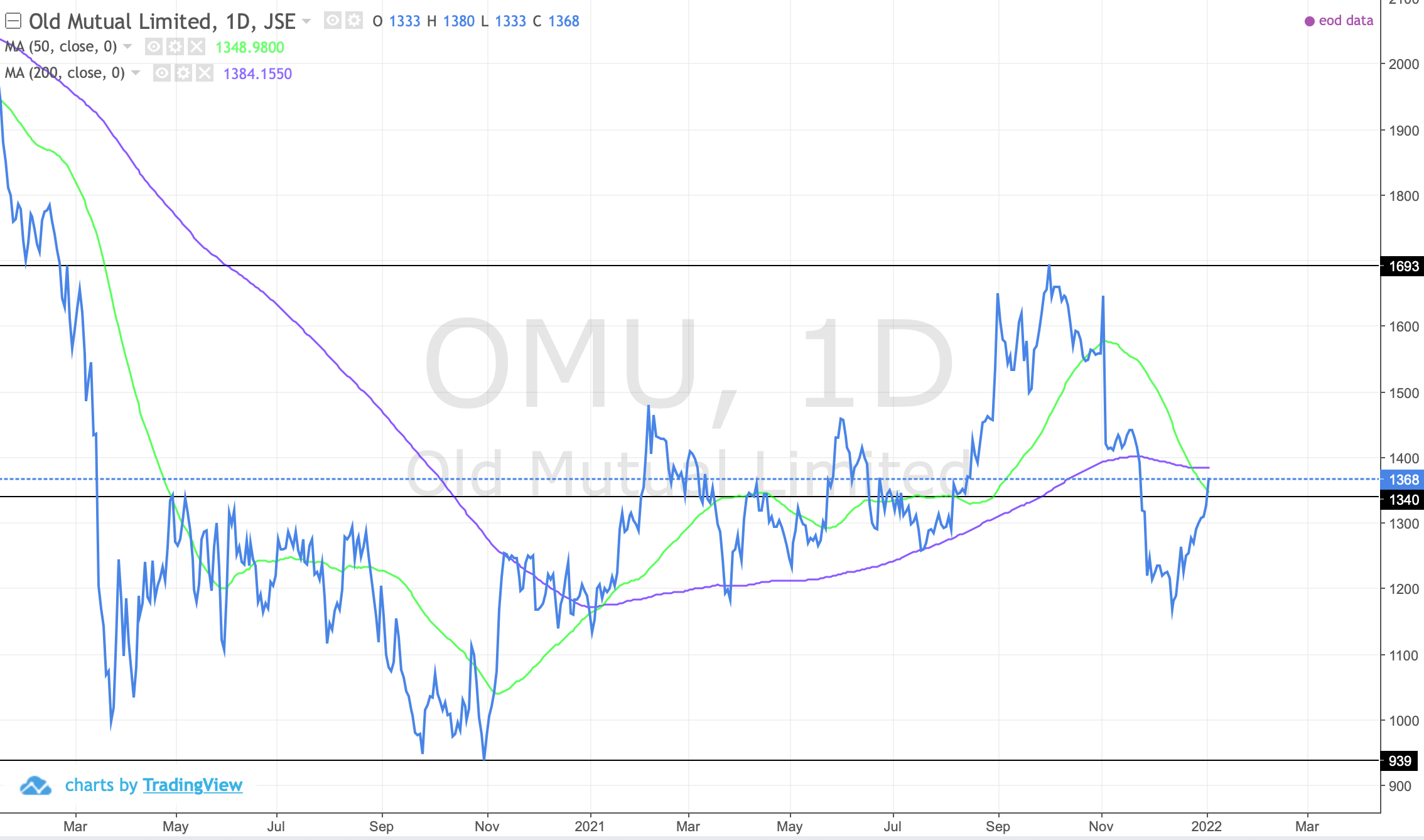

JSE:OMU (Old Mututal)

Positive move above the midline of the sideways channel. Not all good news though as we see a recent death cross. Failure to move above 1444 signals a lower high and makes a move down more likely.

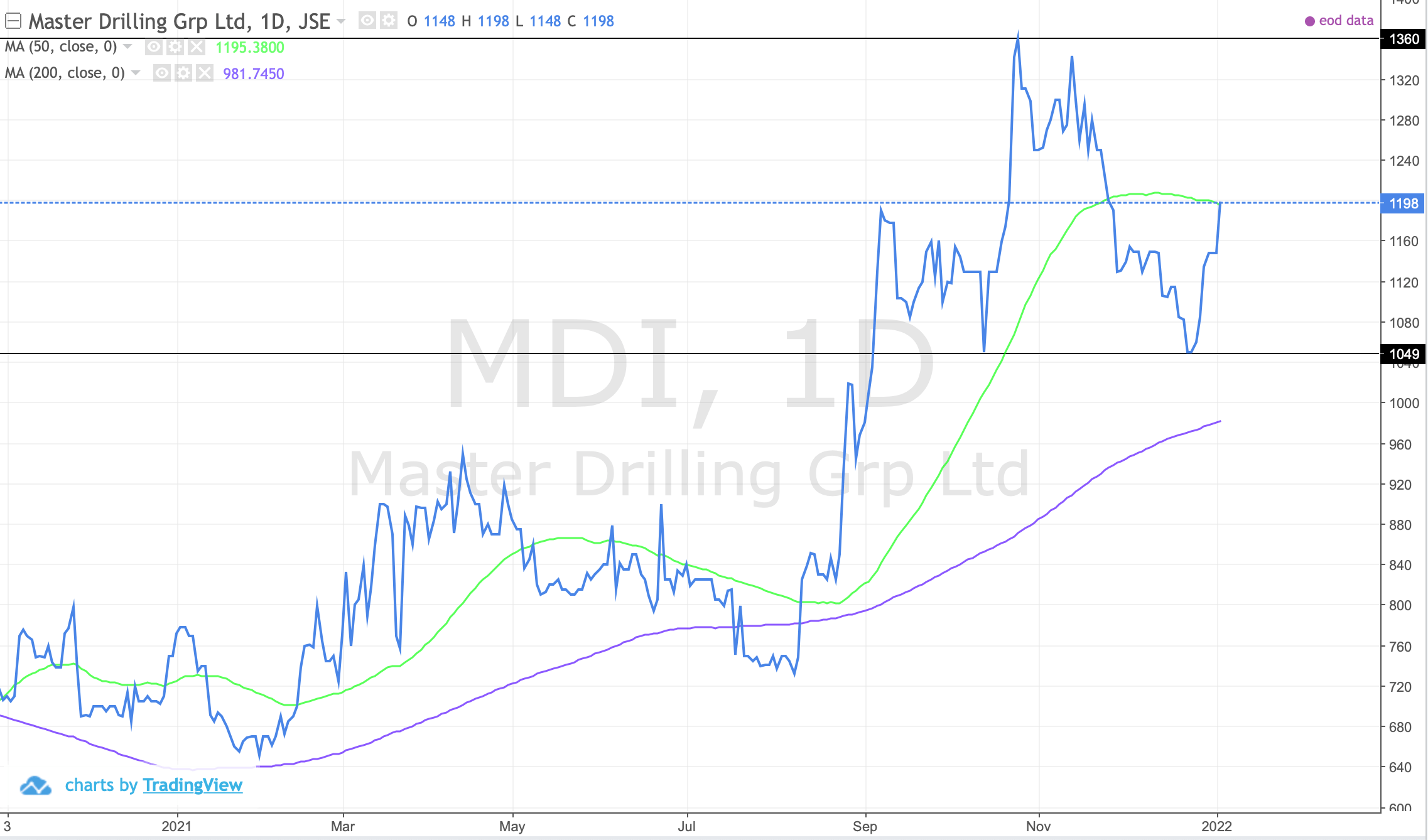

JSE:MDI (Master Drilling)

Positive break however the head and shoulders pattern has formed. Amove above 1360 in the near future is requiredotherwise we are still on shaky ground.

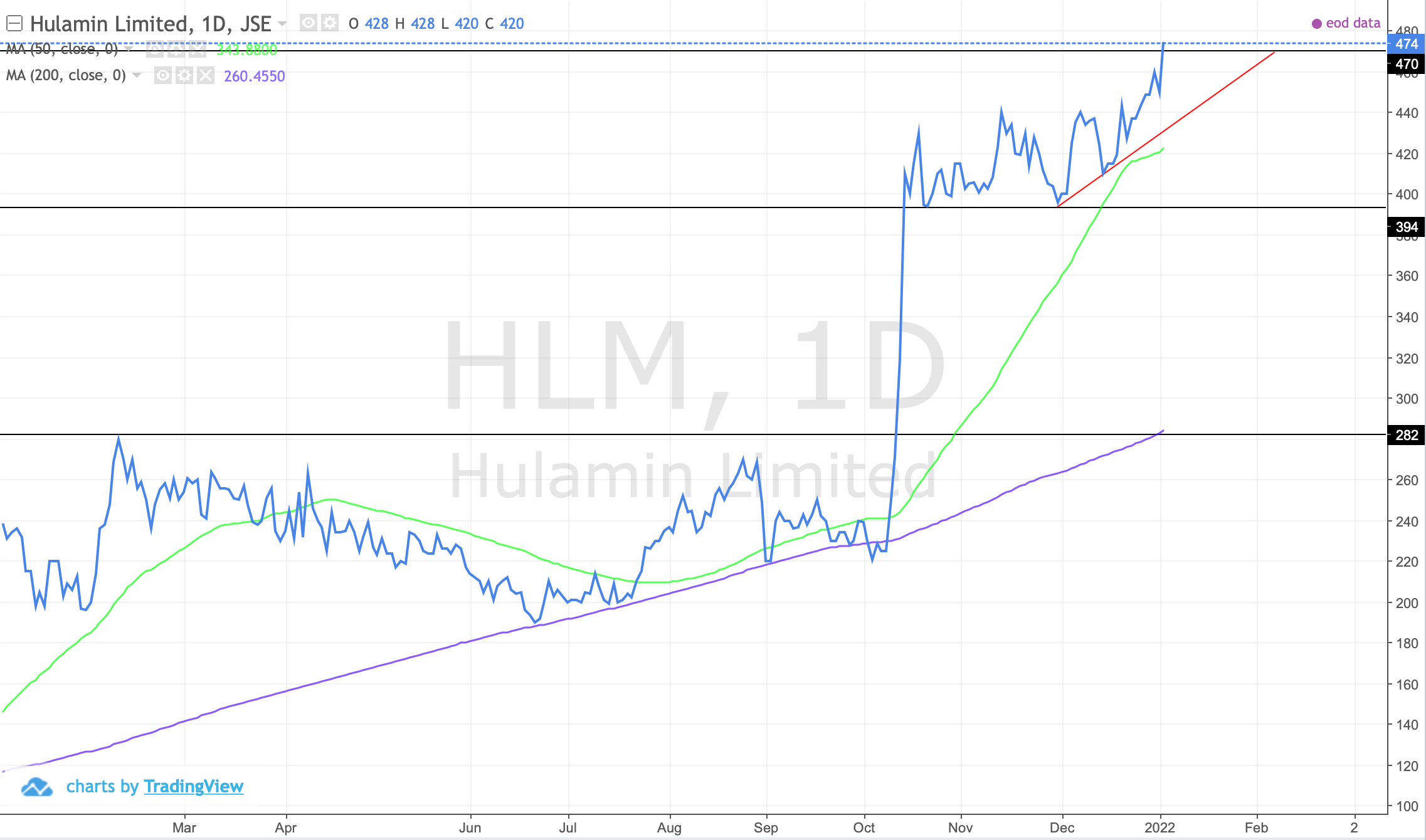

JSE:HLM (Hulamin)

Positive break. Higher highs and lows. Targeting 500 and beyond...

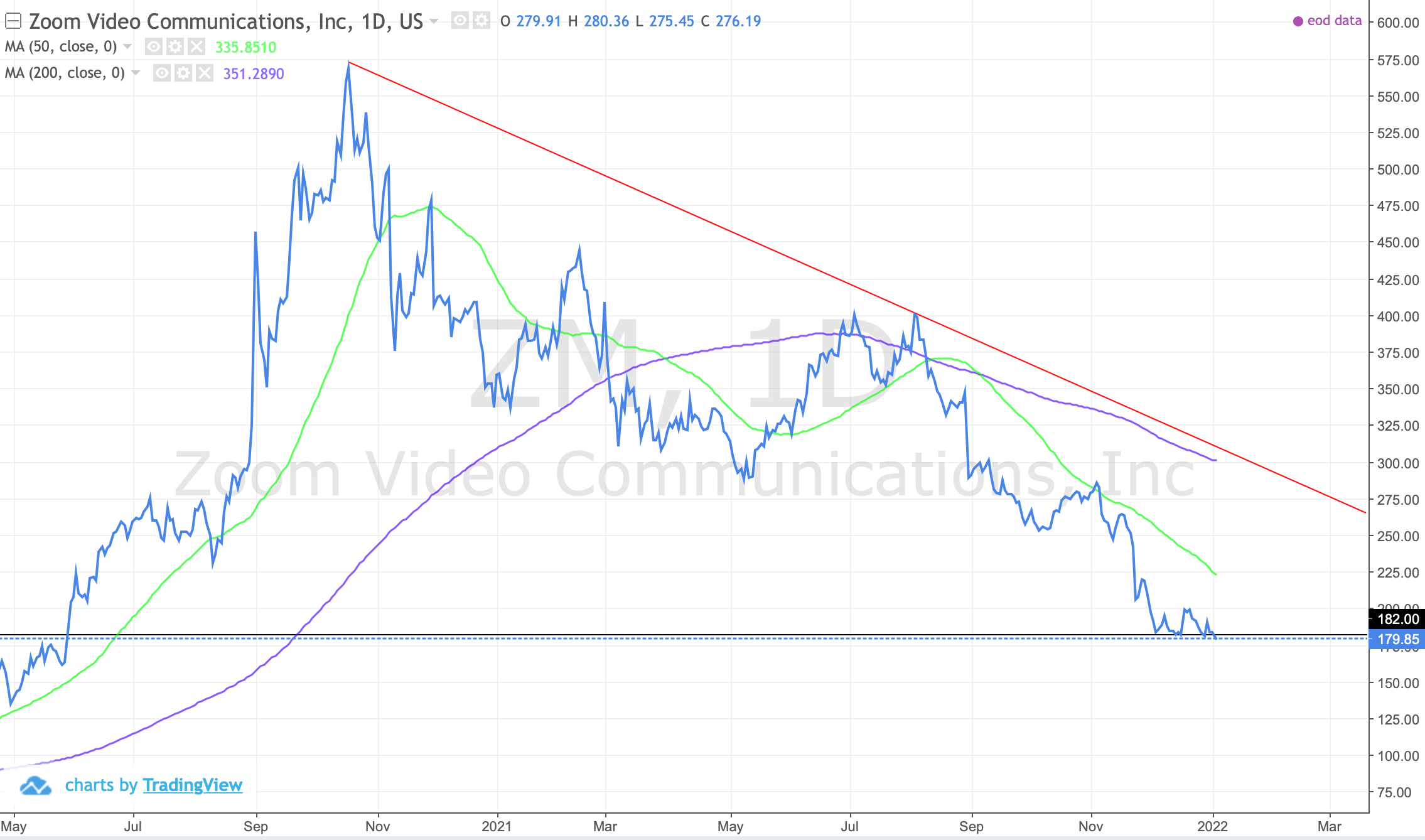

US:ZM (Zoom)

Negative break. Horrible. Not one for me.

This kind of post is usually only made available to paid members, however from time to time it will be made public.

Comments ()