Trading Technique - Range Bound (TBS)

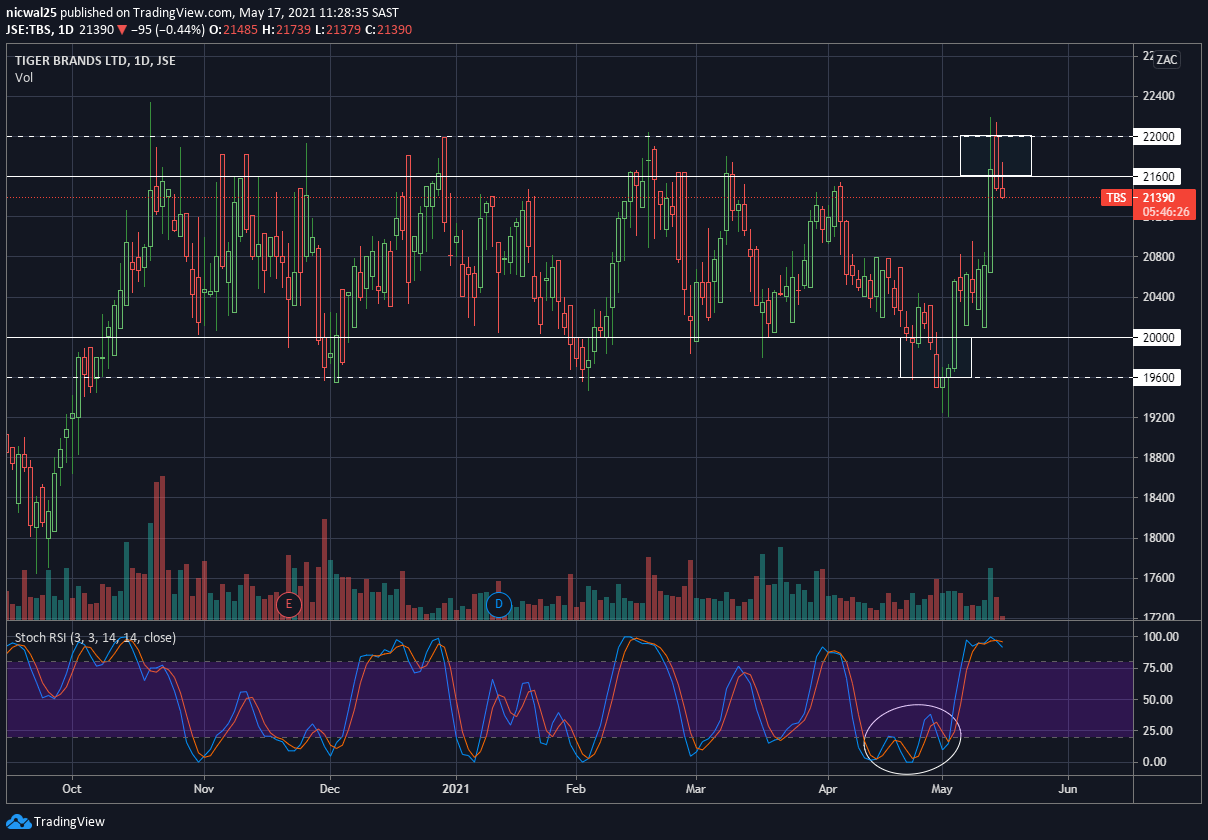

In this week’s look into how I trade, we’re going to focus on range bound trades. I will use TBS (Tigerbrands) as an example.

In this week’s look into how I trade, we’re going to focus on range bound trades.

The share that I prefer at the moment is Tiger Brands (TBS)

TBS for the last 8 months has been trading within a sideways range, given rise to many opportunities within just this one stock.

The idea here is to buy at the low end of the range and sell at the top end of the range.

Once you sold the top you can short the share back down to the low end, this way you reap the rewards of both the movement up and down.

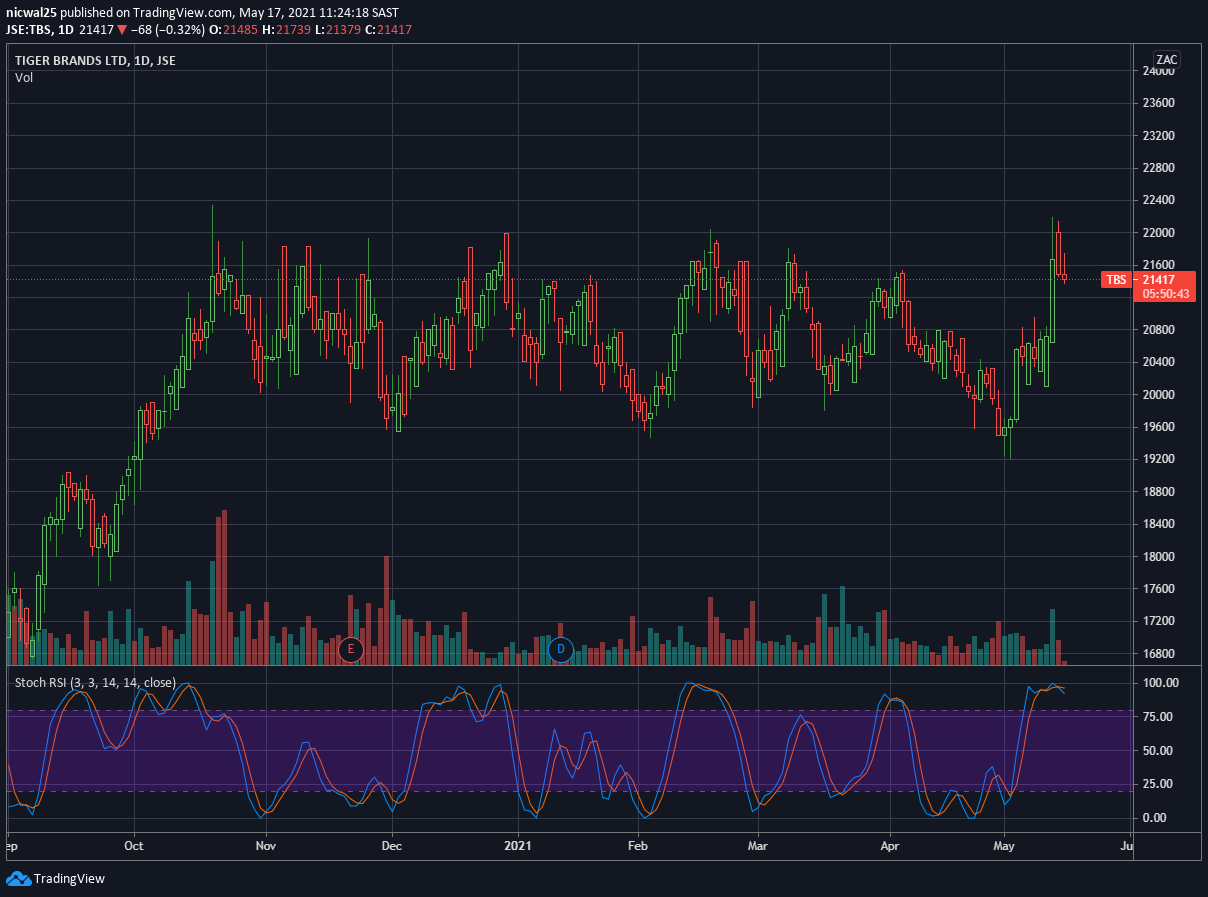

When I first look at the chart, I’m going to look for areas or zones of interest.

I’ll go ahead and add a trend line to the top and bottom finding points where the price turns around the most, as seen below.

Again, we are trying to find zones where price tends to hold, turn and then move the opposite way.

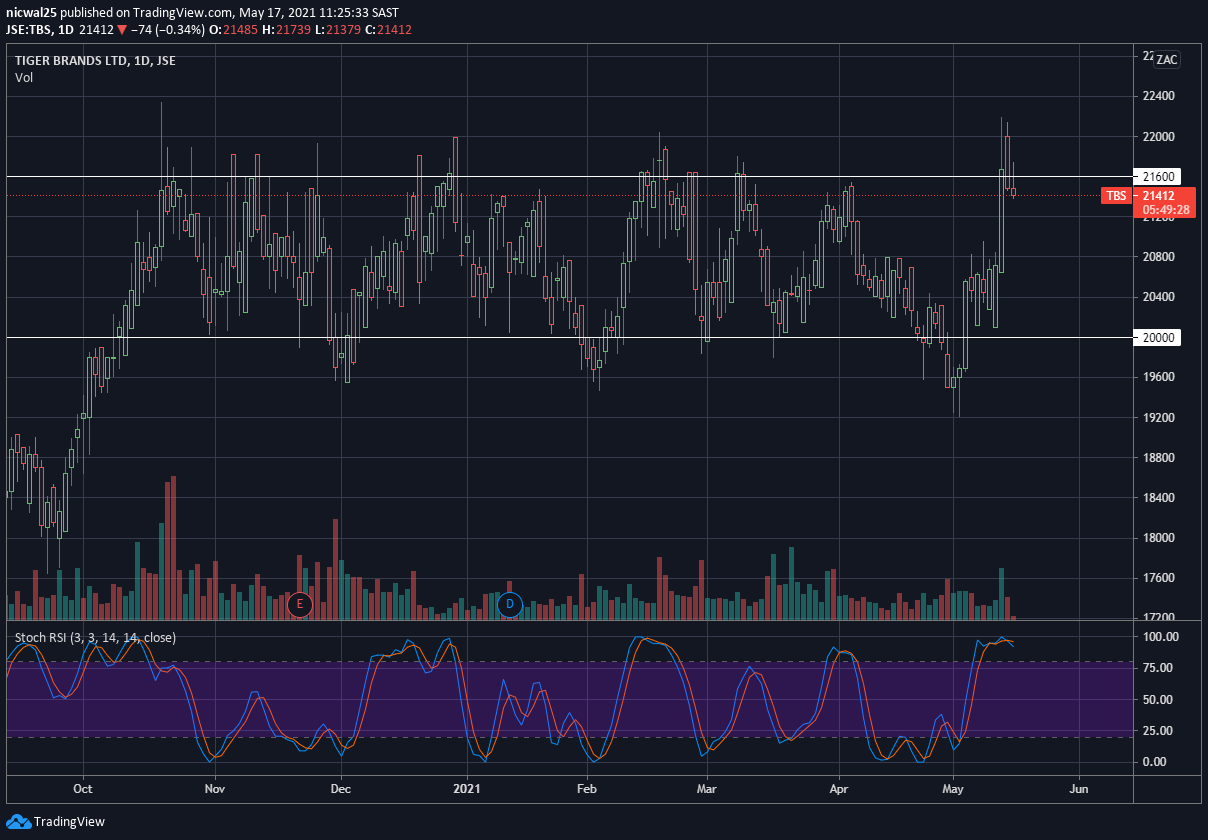

Now let’s add a trend line to capture the outer tops and bottoms where price may have moved beyond our first set of trend lines.

This will give us a nice zone to look for entries and exits within.

As you can see above there was a turnaround 3 times in the past for a long position around the R195.00 area and another 3 or 4 times long in the R200 area.

This will be the zone to start loading up for the next turn around to the long side, for me it’s important to capture a zone, as this will give you the best success rate.

Markets will never be perfect and being focused on capturing a specific price over a zone will likely lead to fewer opportunities.

Taking R195.00 long only would have given us 3 trades, whereas loading on zones from R200.00 down to R195.00 gave us at least 6 long trades.

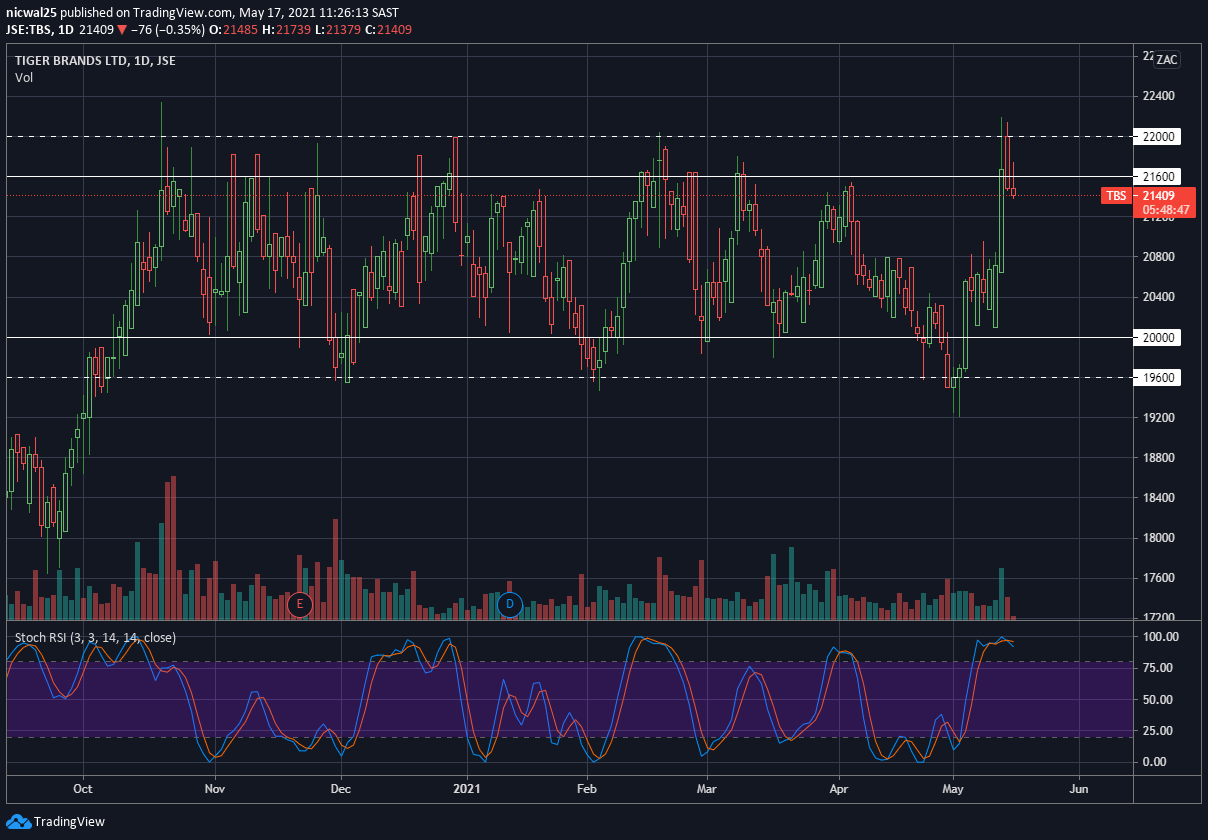

Beyond looking for zones, I will also look at the RSI.

The RSI indicates that the stock is currently in an overbought or an oversold zone.

Once the price reaches the target zone we start offloading.

Then you could short the stock back down to the bottom zone, looking for a re-entry to go long.

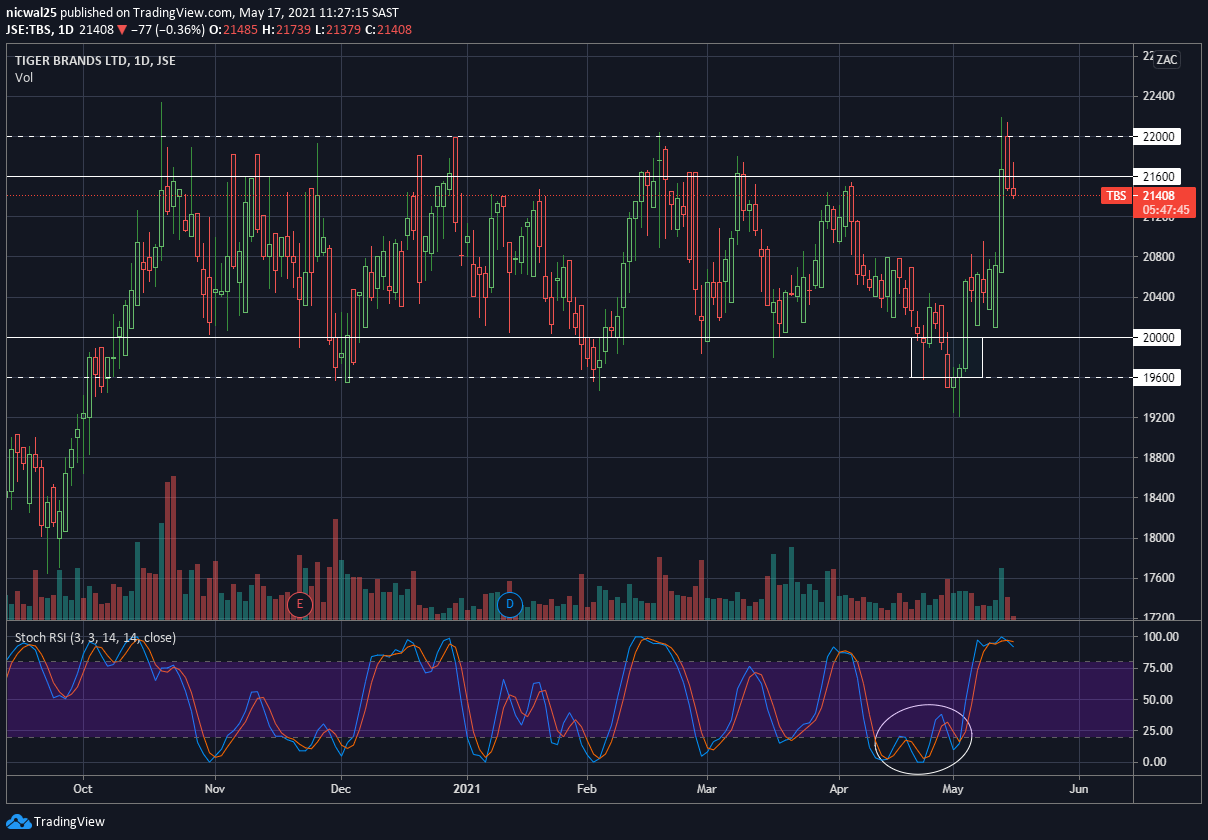

As you can probably tell, you could easily trade just this one stock and give yourself multiple opportunities long and short. This is a fairly simple strategy and that’s just the way I like it!

Simple Strategy Breakdown

- Easy to notice areas where bulls take over and bears take over

- Stock has been trading in a well-defined range

- RSI oversold

- Stock is in the low end of the zone

With all that said, you should always make sure you have your risk parameters set and that you stick to it, as the stock could easily break this range on good or bad news!

I hope this brings some insight into a very simple trading set up.

Comments ()