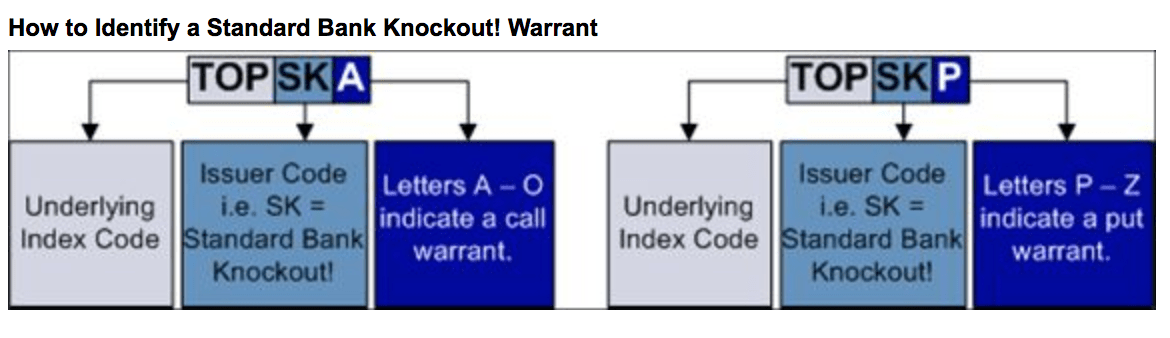

Warrant Pick: TOPSKY

A guest post on the TOPSKY warrant by VectorEquilibrium

Instrument Type

Knockout Warrant

Instrument Symbol

TOPSKY

Term

245 Days (Early November)

Process

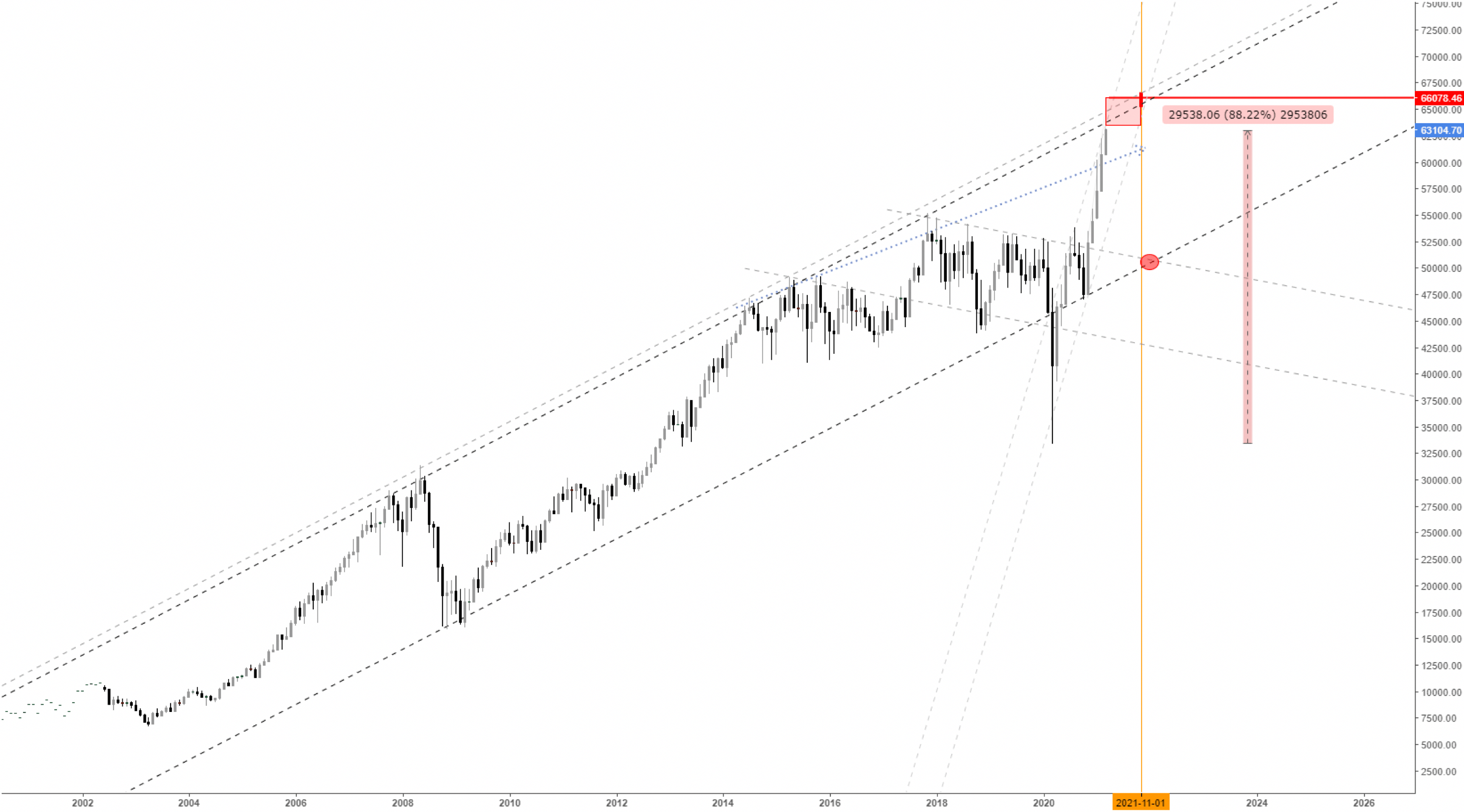

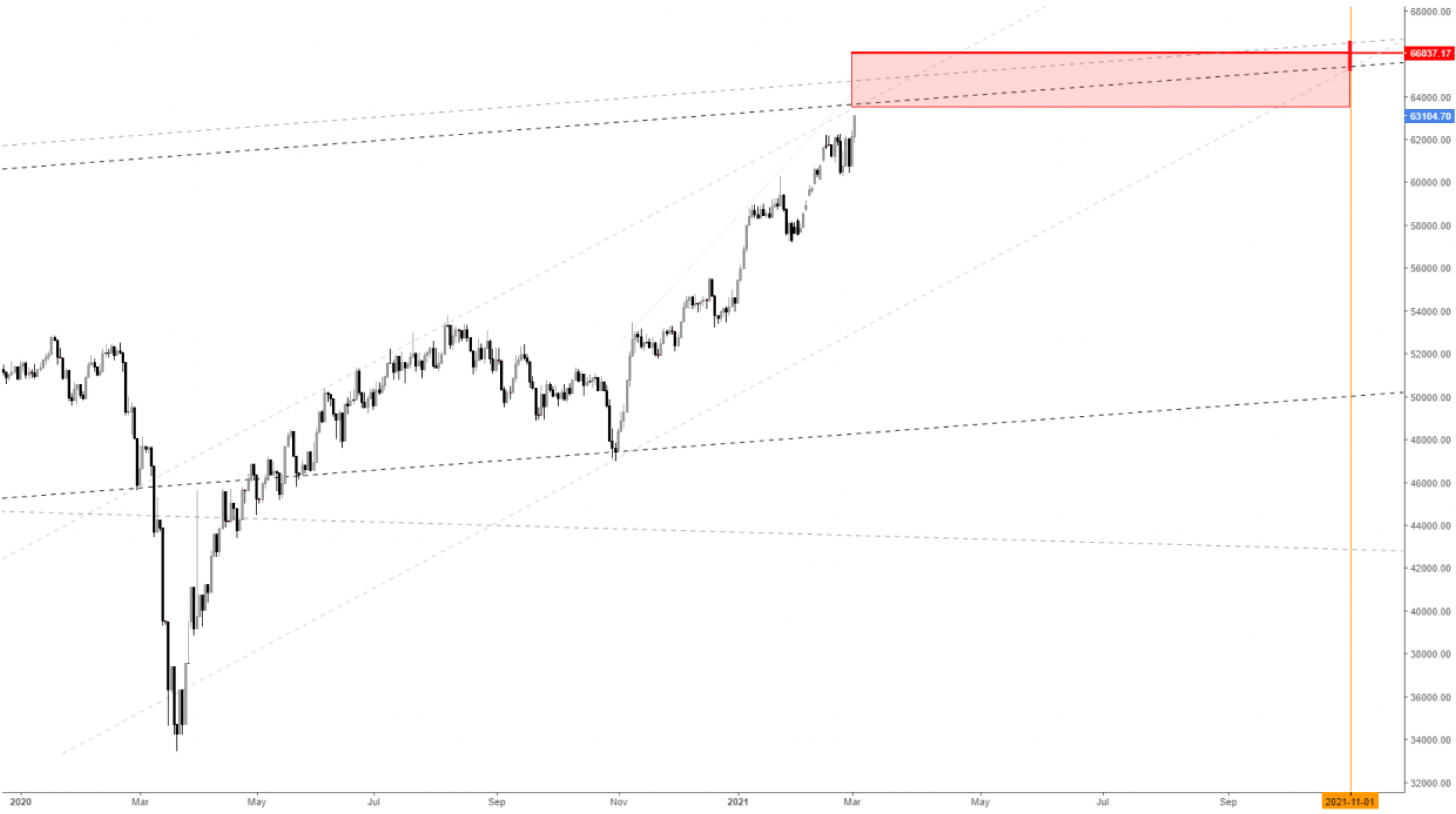

Short accumulation through index value 62500 - 66000

Most warrants are doomed from the moment they come to market, but on the rare occasion a warrant with the metrics to match the times can be found. Warrant TOPSKY, a put, with a barrier function, currently trading at just under 900c. The journey up (through the red block) will see TOPSKY lose value as the index value approaches 66000 (red horizontal line). Should the index value hit 66000 TOPSKY will cease to trade, resulting in a total loss.

That’s the bad news, but there is good news too. Throughout the journey through the block (63000, 64000, 65000), the price of TOPSKY will fall (900c to 700c, to 500c), but gearing will grow (10x to 20x, 30x)

In order to properly appreciate the use of such an instrument it is best to think of each an entry as an insurance premium, with each premium cheaper than the next, affording ever greater protection from a major market correction.

In the case of this specific warrant, from the perspective of both time and knockout point, coverage intensity happens to hit its apex inside the point of highest pivot probability on the TOP40, (somewhere between 63500 and 65000).

SCENARIOS

Market goes up

Should the barrier be breached, we will be entering a new paradigm. There are very few technical references above 66000 other than simply extrapolating the markets primary long term range up one cycle, which would put the index point value at somewhere in the 80000s, and as such you will likely be making so much money on your longs that you’ll forget you ever bought the little put on the index

Market goes down

With a comfortable and specific total investment in mind, by scaling that value into the TOPSKY as the index rises, in this case four allotments of equal volume (or equal monetary value if you prefer), your average gearing will rise with each entry. Should the market turn down anywhere inside the red blocks range, you will be holding a short, at the top of the market, at a gearing of anywhere between 15 and 30.

I would suggest the below entry structure. Values based on one’s personal coverage requirement.

CONCLUSION

Given the relatively short distance to 66000, it should go without saying that this trade holds an extremely low probability of success, BUT should the technical’s play out as suggested, and the market experience a drawdown in proportion to those previously seen through the primary channel (between ---20% and -40%) one will have purchased comprehensive equity drawdown insurance at the best possible time, at the best possible price

Comments ()